In the fast-paced and competitive world of trading, strategies play a vital role in determining the success or failure of an investor. One strategy that has been gaining considerable attention recently is the Power of Trading’s 300% profit strategy. This approach claims to offer the potential for an impressive 300% return on investment, enticing traders with the promise of substantial profits. However, like any trading strategy, it is essential to examine the details and evaluate whether it truly lives up to the hype.

The Power of Trading’s 300% profit strategy aims to capitalize on short-term market movements and volatility, leveraging specific indicators and technical analysis tools to identify potential entry and exit points. Proponents of this strategy argue that it allows for quick and sizable gains, making it an attractive option for those seeking significant returns within a short timeframe. However, it is crucial to approach such claims with caution and conduct thorough research before committing any capital.

While the allure of a 300% profit strategy may be tempting, it is important to remember that trading is inherently risky, and no strategy can guarantee consistent or extraordinary profits. It is advisable for traders to thoroughly understand the underlying principles and risks associated with any strategy they choose to adopt. Additionally, it is crucial to consider factors such as market conditions, risk tolerance, and personal trading goals when evaluating the viability of a particular strategy. Ultimately, successful trading requires a combination of careful analysis, risk management, and adaptability, and traders should exercise due diligence before embracing any strategy, including the Power of Trading’s 300% profit strategy.

Understanding the Power of Trading’s Strategy

The Power of Trading’s strategy is built on the principle of capitalizing on short-term market movements and volatility. It involves utilizing various technical analysis tools and indicators to identify potential entry and exit points for trades. The strategy aims to take advantage of rapid price fluctuations, allowing traders to potentially achieve substantial profits within a relatively short timeframe.

The Power of Trading’s strategy relies on chart patterns, trend lines, moving averages, and other technical indicators to identify trading opportunities. It involves both long and short positions based on market conditions and specific trade setups. However, achieving consistent and significant profits in trading is challenging and carries inherent risks. Traders must understand technical analysis, risk management, and adaptability. Thorough research, testing, and consideration of individual risk tolerance and financial goals are crucial before committing real capital to any trading strategy, including the Power of Trading’s approach.

The Role of TradingView Indicators

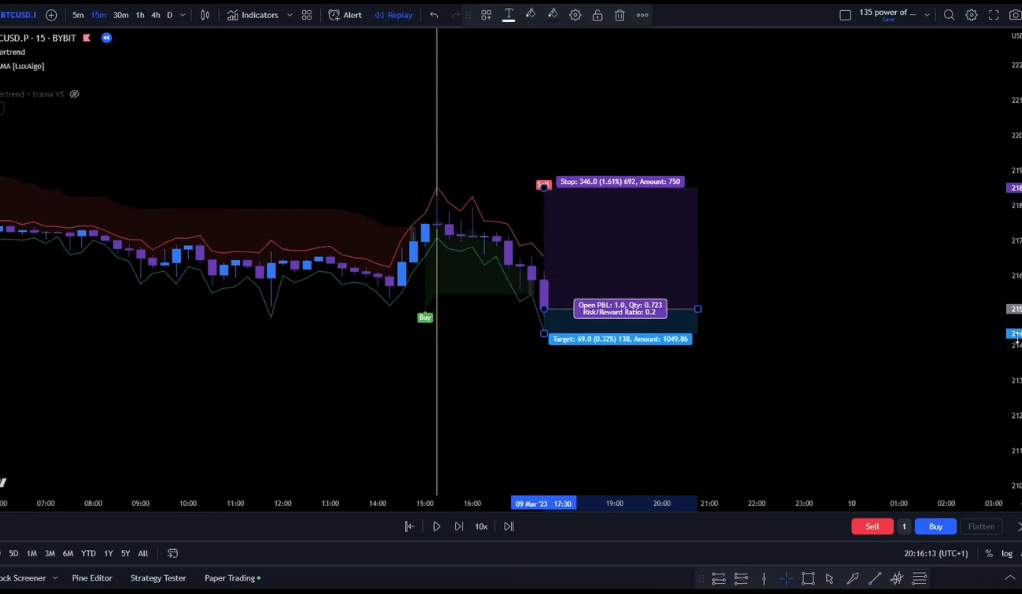

The Power of Trading’s strategy heavily relies on the utilization of two free TradingView indicators, which are believed to be essential in making profitable trades. These indicators, when combined, are said to provide valuable insights and signals for traders. One of the advantages of these indicators is their versatility, as they can be applied across different time frames, allowing the strategy to be adaptable to various trading styles.

TradingView indicators play a crucial role in the Power of Trading’s strategy, offering insights into market trends, price movements, and entry/exit points. These visual representations of technical analysis tools aid traders in interpreting information and making informed decisions. The indicators’ versatility across different time frames allows for analysis of short-term and long-term market dynamics, potentially improving profitability. However, traders must interpret and apply these indicators effectively. Understanding their parameters, alignment with the overall trading strategy, and combining them with other analysis and risk management techniques are essential for maximizing their usefulness.

Automating Backtesting with PineScript

An essential component highlighted in the strategy review is the utilization of PineScript for automating the backtesting process. Backtesting is a critical step in evaluating the viability and performance of a trading strategy by simulating trades using historical data. PineScript, a programming language specifically designed for TradingView, enables traders to automate this process, offering significant time-saving benefits and increased efficiency.

By utilizing PineScript, traders can create custom technical indicators, trading signals, and even complete trading strategies. These scripts can be applied to historical price data, allowing traders to assess the strategy’s performance under various market conditions. PineScript provides a range of built-in functions and libraries that simplify the implementation of complex trading ideas and strategies. The automation of backtesting with PineScript eliminates the need for manual calculations and analysis, providing traders with faster and more accurate results.

Combining Indicators: A Game Changer?

The strategy emphasizes the potential benefits of combining indicators using PineScript to create a more robust and comprehensive trading system. By combining multiple indicators, traders aim to capture a broader range of market signals and enhance their decision-making process. This approach allows for a more holistic analysis of market conditions and can potentially provide a deeper understanding of trade setups. However, whether this combination truly yields the promised 300% profit can only be determined through thorough backtesting and real-world application.

While combining indicators may offer advantages, it is important to approach the claim of a 300% profit with caution. Trading outcomes are influenced by various factors, including market volatility, economic events, and individual trading skills. Backtesting, which involves simulating trades using historical data, can provide valuable insights into the performance of a combined indicator strategy. Additionally, real-world application and live trading are necessary to validate the strategy’s effectiveness in dynamic market conditions. Traders should consider conducting extensive backtesting and carefully monitoring their trading results to evaluate the viability and profitability of the combined indicator strategy.

The Strategy in Action: Does it Deliver?

The performance of the Power of Trading’s strategy, which claims a 300% profit, can only be truly assessed through real-world application and diligent monitoring of the results. While the strategy may appear promising on paper, it is essential to consider that trading involves inherent risks and uncertainties. Real-world market conditions can significantly impact the performance of any trading strategy, including the Power of Trading’s approach.

Traders who are interested in testing the strategy should carefully implement it in live trading scenarios, while also adhering to proper risk management techniques. By closely monitoring the strategy’s performance over an extended period and analyzing the actual results achieved, traders can gain valuable insights into its effectiveness. It is crucial to consider both the profits and losses experienced during the trading journey, as consistent profitability is a key factor in assessing the strategy’s viability.

Ultimately, it is important to approach any trading strategy, including the Power of Trading’s approach, with a realistic mindset and a thorough understanding of the risks involved. Each trader’s experience may vary, and individual factors such as risk tolerance, trading skills, and market conditions can influence the outcome. By carefully evaluating the strategy’s performance in real-world trading, traders can make informed decisions about its effectiveness and its suitability for their specific trading goals.

The Verdict: Is the Strategy Worth It?

After conducting a comprehensive review, reaching a verdict on the worthiness of the Power of Trading’s 300% profit strategy is not a straightforward task. The strategy does have its merits, such as leveraging free TradingView indicators, which can provide valuable insights into market trends and potential trade setups. Additionally, the automation of backtesting using PineScript offers time-saving benefits and increased efficiency in evaluating the strategy’s performance. However, it is crucial to emphasize that the ultimate effectiveness of the strategy relies heavily on the trader’s skill, experience, and ability to interpret and apply the indicators and backtesting results effectively.

Success in trading is multifaceted and cannot be solely attributed to a specific strategy. Factors such as risk management, psychological discipline, adaptability to changing market conditions, and continuous learning are also crucial elements for long-term profitability. Traders considering the Power of Trading’s strategy should carefully evaluate its components and understand how they align with their own trading goals, risk tolerance, and skill level. Additionally, it is essential to thoroughly backtest the strategy, monitor its real-world performance, and adapt it to individual circumstances to make an informed decision about its worthiness.

Conclusion

In conclusion, the Power of Trading’s 300% profit strategy presents an intriguing proposition for traders. The incorporation of TradingView indicators and the automation of backtesting through PineScript provide valuable tools and efficiency-enhancing capabilities. The strategy holds the potential for traders to gain insights into market trends, identify potential trade setups, and streamline the evaluation of their trading performance.

However, it is important to recognize that the ultimate success of the strategy rests on the trader’s skill, experience, and adaptability. Thoroughly backtesting the strategy and carefully analyzing its performance in real-world trading scenarios is essential to assess its viability and profitability. Traders should approach the strategy with a realistic mindset, taking into consideration factors such as risk management, continuous learning, and psychological discipline.

In the end, traders must remember that no trading strategy guarantees consistent or extraordinary profits. It is crucial to maintain a cautious and informed approach, continuously refine the strategy based on market conditions, and make well-informed decisions. By combining diligent research, critical analysis, and personal trading expertise, traders can navigate the dynamic world of trading and strive for success. Happy trading!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.