Price action trading is a dynamic and popular approach utilized by numerous successful traders. It revolves around the analysis of raw price data and disregards conventional technical indicators, offering a more direct perspective on market movements. Traders who employ this strategy focus on studying price patterns, trends, support and resistance levels, and other crucial aspects of price behavior to make informed trading decisions.

Price action trading allows traders to gain valuable insights into market dynamics and make predictions based on actual price movements. By observing patterns such as breakouts, reversals, and consolidations, traders can identify potential entry and exit points, manage risk, and optimize their profit potential. The strategy is highly adaptable and can be applied to various timeframes, making it suitable for day traders, swing traders, and long-term investors alike.

In the realm of price action trading tools, Lux Algo stands out as a premium resource for traders seeking an edge in the markets. Lux Algo provides advanced features and indicators designed to enhance price action analysis and decision-making. With Lux Algo, traders can access tools such as trend identification, support and resistance levels, volume analysis, and dynamic price alerts. These features empower traders to make well-informed decisions based on comprehensive price analysis, leading to increased precision and effectiveness in their trading strategies.

The Intricacies of Price Action Trading Strategy

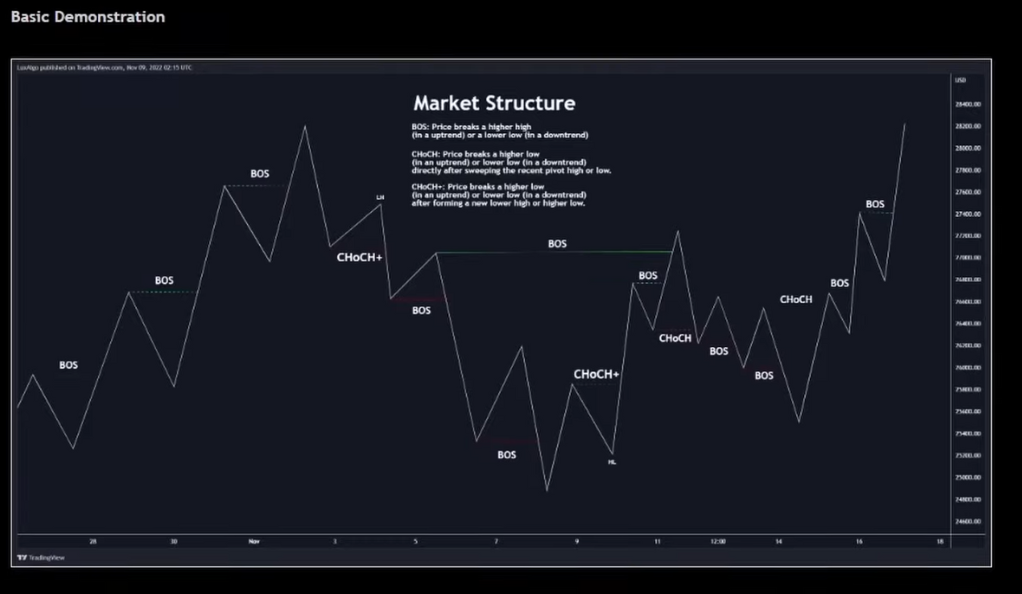

The Price Action Trading Strategy is based on the belief that price movements and patterns in the market contain valuable information. It focuses on analyzing raw price data, such as candlestick patterns, trendlines, support and resistance levels, and chart formations, without relying on traditional technical indicators. This strategy emphasizes studying how price reacts to these factors, rather than trying to predict future price movements based on lagging indicators.

One of the key advantages of the Price Action Trading Strategy is its versatility. It can be applied to any financial instrument and timeframe, making it suitable for traders with different trading styles and preferences. By closely observing price action, traders can identify significant levels of buying or selling pressure, potential breakouts or reversals, and other important market dynamics. This strategy enables traders to make more informed decisions based on actual market conditions and can provide a clearer understanding of market sentiment.

The Essence of Price Action Trading

At the heart of price action trading is the belief that all relevant information about the market is reflected in the price itself. Traders who employ this strategy study candlestick patterns, chart formations, and support and resistance levels to identify potential trading opportunities. By analyzing how price behaves in relation to these factors, traders can gain insights into market sentiment, supply and demand dynamics, and potential future price movements.

Price action trading offers several advantages to traders. Firstly, it eliminates the lagging nature of traditional technical indicators, providing a real-time view of the market. This allows traders to make more timely and informed trading decisions. Secondly, it simplifies the decision-making process by focusing on the most crucial aspect: the price itself. By interpreting price patterns and trends, traders can identify high-probability trading setups and effectively manage risk. Additionally, price action trading can be combined with other trading techniques and strategies to enhance overall trading performance.

The Power of Flexibility in Price Action Trading

The flexibility of price action trading lies in its ability to adjust to various market conditions. Unlike strategies that heavily rely on specific technical indicators, price action traders can adapt their approach based on the current market environment. Whether the market is trending, ranging, or experiencing volatility, price action traders can analyze price patterns, candlestick formations, and support and resistance levels to make informed trading decisions.

This adaptability is crucial in the ever-changing landscape of trading. Markets can quickly shift from trending to choppy or from volatile to calm, and traders need to be able to adjust their strategies accordingly. Price action trading provides the necessary tools and techniques to navigate through different market scenarios. Traders can employ different entry and exit strategies, adjust their risk management techniques, and utilize various timeframes to align with the current market conditions. This flexibility enables traders to stay nimble and responsive, increasing their chances of success.

The Role of Lux Algo in Price Action Trading

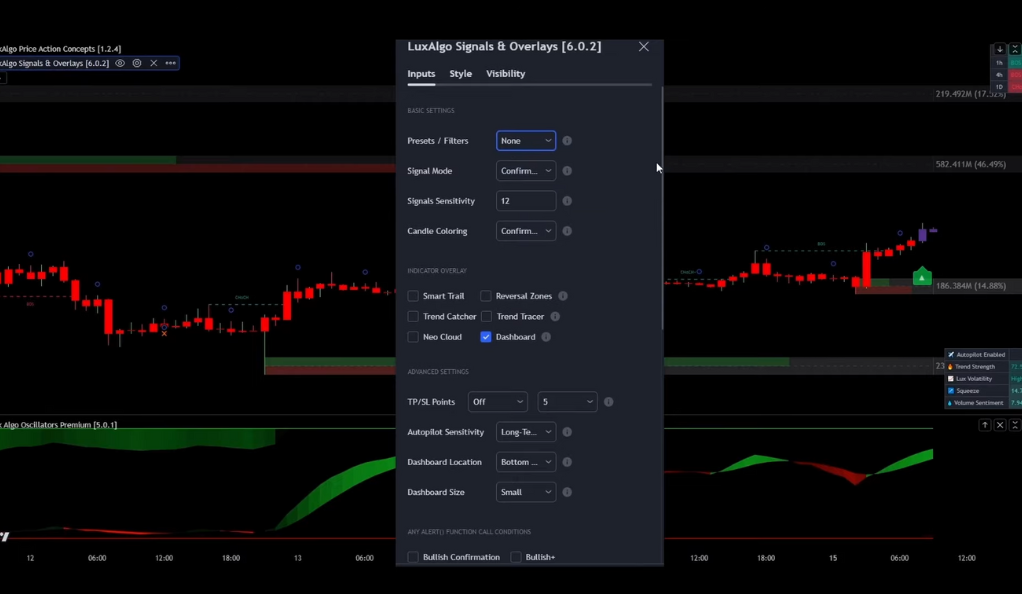

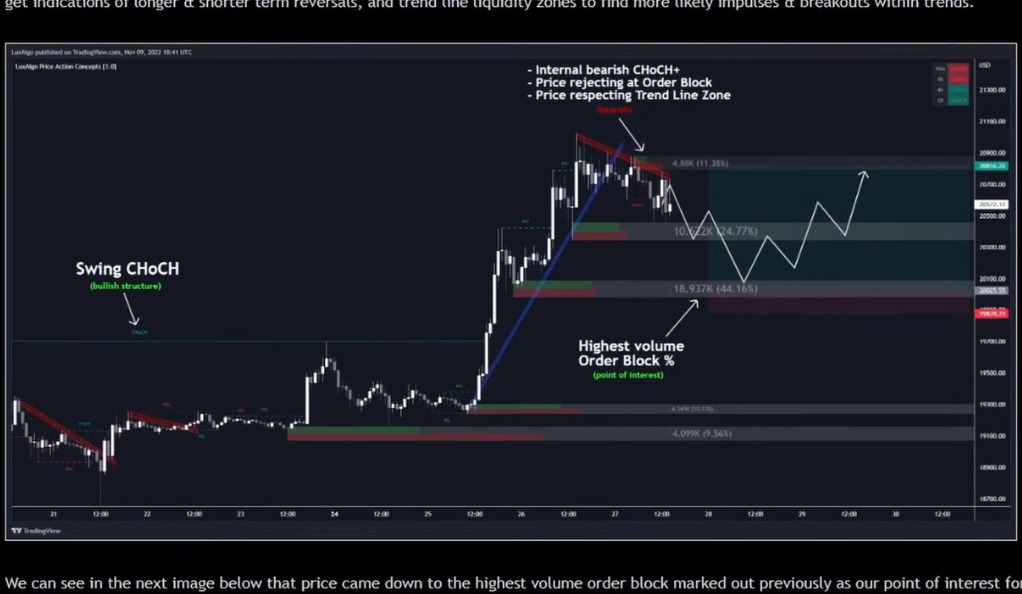

Lux Algo plays a significant role in supporting price action trading strategies by providing advanced features and indicators that complement the analysis of raw price data. Traders can utilize Lux Algo to enhance their understanding of market dynamics and identify high-probability trading opportunities. With Lux Algo’s features, such as trend identification, support and resistance levels, volume analysis, and dynamic price alerts, traders can gain valuable insights and make more informed trading decisions.

Lux Algo’s trend identification feature can help traders identify and confirm trends in the market, allowing them to align their trades with the prevailing direction of price movement. The support and resistance levels provided by Lux Algo act as a guide for traders to identify potential areas of price reversal or continuation, aiding in precise entry and exit points. By incorporating volume analysis, Lux Algo allows traders to assess the strength of price movements, providing further confirmation for trading decisions. Additionally, dynamic price alerts from Lux Algo ensure that traders stay informed about critical price levels and potential trading opportunities.

An Overview of Lux Algo

Lux Algo is a comprehensive trading tool that offers a wide range of features designed to enhance the technical analysis process for traders. With over 20 features, Lux Algo provides traders with a multitude of indicators and signals to support their price action trading strategies. These features include various overlays, indicators, and alerts that cater to different trading styles and preferences.

One of the key strengths of Lux Algo is its ability to provide robust and real-time data. The indicators and signals offered by Lux Algo are based on up-to-date market information, ensuring that traders have access to accurate and timely insights. This real-time data allows traders to make swift and well-informed decisions, enabling them to capitalize on market opportunities efficiently.

Using Lux Algo in Price Action Concepts

Lux Algo serves as a powerful tool for traders looking to incorporate price action concepts into their trading strategies. By using Lux Algo, traders can simplify the process of interpreting raw data and gain actionable insights that can inform their trading decisions. Lux Algo’s features and indicators align with key price action concepts, allowing traders to analyze price patterns, identify support and resistance levels, and spot potential trend reversals or breakouts more effectively.

Recognizing Entry Signals and Booking Profits

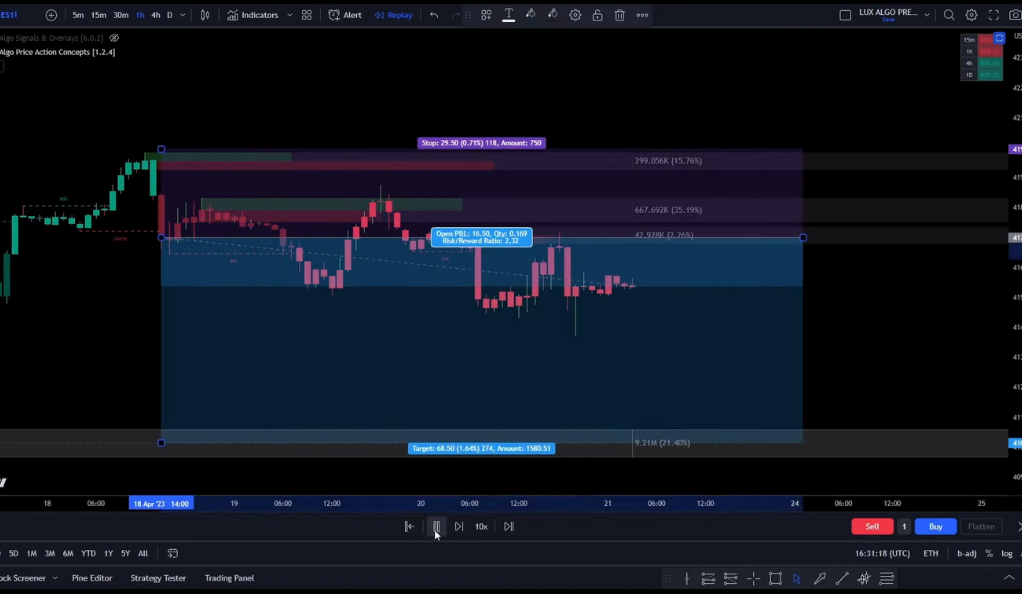

Recognizing entry signals and effectively booking profits are crucial aspects of successful trading. Traders need to identify opportune moments to enter trades based on their trading strategies and market analysis. This involves understanding price action patterns, support and resistance levels, trend confirmations, and other indicators that indicate favorable entry points. By carefully analyzing these factors, traders can increase the probability of entering trades at advantageous prices, maximizing their potential for profit.

Deciphering Valid Entry Signals

Deciphering valid entry signals in price action trading requires the satisfaction of specific conditions that confirm the potential for a profitable trade. While the exact conditions were not outlined in the initial overview, they are key to the effectiveness of this strategy. Price action traders typically look for a combination of factors to validate their entry signals.

The Art of Profit Booking

This strategy helps traders maximize their profits by exiting positions at favorable levels while reducing the risk of holding onto trades for too long. It aligns with the principle of taking profits before a potential reversal or consolidation period, allowing traders to secure gains and protect their capital. By incorporating this profit booking approach into their trading strategy, traders can strike a balance between maximizing profitability and managing risk effectively.

The Winning Combination of Price Action Trading and Lux Algo

The combination of price action trading and Lux Algo creates a powerful synergy that can provide traders with a significant edge in the market. Price action trading offers a straightforward and intuitive approach, allowing traders to analyze raw price data and make trading decisions based on actual market conditions. Lux Algo, with its advanced features and indicators, further enhances this approach by providing additional insights and tools to optimize trading strategies.

A Harmonious Trading Relationship

The combination of price action trading and Lux Algo forms a harmonious trading relationship that enhances traders’ ability to navigate the market effectively. Price action trading provides a direct and intuitive approach to analyzing price movements and patterns, enabling traders to make informed decisions based on raw data. Lux Algo, on the other hand, offers advanced features and indicators that further augment price action analysis, providing additional insights and confirmation signals.

Harnessing the Power of Technology

The integration of technology, such as Lux Algo, with price action trading brings a new level of sophistication to the traditional approach. Lux Algo harnesses the capabilities of advanced algorithms and data analysis to provide traders with comprehensive tools and indicators that enhance their trading strategies. By incorporating technology into price action trading, traders can leverage the benefits of automation, real-time data, and advanced analytics to navigate the market more effectively.

Conclusion

Trading can be a complex endeavor, but the Price Action Trading Strategy, complemented by the Lux Algo tool, simplifies the process by focusing on the essential elements of trading. This combination empowers traders with an approach that is both direct and technologically advanced, setting the stage for successful market ventures.

By going back to basics with price action trading and utilizing the modern capabilities of Lux Algo, you may find a trading strategy that’s not only efficient but also more attuned to the market’s pulse. After all, isn’t it exciting to think that the keys to trading success might be right in front of us, hidden in plain sight within the raw data of price action? Happy trading!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)