In the fast-paced world of cryptocurrency trading, scalping has emerged as a highly popular and potentially lucrative strategy. Derived from the traditional stock market, scalping involves making rapid trades to profit from small price fluctuations within a short time frame. In cryptocurrency scalping, traders execute multiple trades throughout the day, aiming to capitalize on the volatile nature of digital assets. The goal is to accumulate numerous small gains that, when combined, can lead to significant overall profits. However, it’s essential to approach scalping with caution, as it requires precision, discipline, and a deep understanding of market dynamics.

Effectively applying scalping in cryptocurrency trading demands a well-thought-out approach and adherence to specific principles. Firstly, traders must choose highly liquid and actively traded cryptocurrencies to ensure quick execution and minimal slippage. Additionally, having access to a reliable trading platform with advanced charting tools is crucial for analyzing price movements and identifying potential entry and exit points. Traders should set clear profit targets and stop-loss levels to manage risk effectively. Since scalping involves frequent trades, transaction costs can add up, making it necessary to keep a close eye on fees. Moreover, traders need to remain calm and unemotional, as quick decision-making is paramount in this strategy. While scalping can be highly profitable, it is also mentally demanding, making it suitable for experienced and disciplined traders who can handle the rapid pace and inherent risks of this dynamic trading approach.

Understanding Scalping

Scalping is a popular trading strategy that has gained traction in the cryptocurrency market due to its potential for rapid returns. The essence of scalping lies in its frequency of trades, with traders executing multiple buy and sell orders within a single day. The main objective is to capitalize on small price movements, often exploiting the bid-ask spread—the difference between the buying and selling prices of an asset. While each individual gain might be modest, the cumulative effect of these frequent trades can lead to substantial profits over time. This approach is well-suited for the fast-paced and volatile nature of cryptocurrencies, where price fluctuations can occur swiftly and unpredictably.

To effectively implement the scalping strategy in cryptocurrency trading, traders need to stay vigilant and agile. Quick decision-making is essential, as opportunities arise and vanish rapidly. Due to the high frequency of trades, traders must have access to a reliable and efficient trading platform with low transaction costs to avoid eroding potential profits. Additionally, risk management is critical in scalping, and setting tight stop-loss orders is a common practice to limit potential losses. As with any trading strategy, success in scalping requires discipline, a thorough understanding of market dynamics, and continuous monitoring of price movements.

Short Entry

A short entry in trading refers to the act of selling an asset with the expectation that its price will decrease in the future. Traders initiate short positions when they anticipate a downtrend or bearish market movement. To enter a short trade, they first borrow the asset from a broker and sell it at the current market price. Later, they aim to repurchase the asset at a lower price, thus profiting from the price difference. Short entries are often used to capitalize on declining markets or when technical indicators signal potential price reversals.

Long Entry

Conversely, a long entry in trading involves buying an asset with the anticipation that its price will rise over time. Traders initiate long positions when they expect an uptrend or bullish market movement. To enter a long trade, they purchase the asset at the current market price and hold it with the hope of selling it at a higher price in the future, generating a profit from the price appreciation. Long entries are common in markets where the overall sentiment is positive and investors anticipate upward price movements.

The Three Pillars of Scalping: Secret EMA Cloud, BX Trender, and Average Directional Index

The Secret EMA Cloud, BX Trender, and Average Directional Index (ADX) form the three pillars of scalping in cryptocurrency trading. Each indicator plays a crucial role in helping traders make informed decisions and seize opportunities in the fast-paced crypto market.

The Secret EMA Cloud is a proprietary tool that combines Exponential Moving Averages (EMAs) with a cloud-like formation. This indicator assists in spotting trends and determining potential support and resistance levels. When the price stays above the cloud, it indicates an uptrend, while a drop below the cloud suggests a downtrend. Additionally, the crossover of EMAs within the cloud can generate entry and exit signals. Alongside the Secret EMA Cloud, the BX Trender is another significant component of the scalping strategy. It is designed to identify the strength and direction of a trend, helping traders determine when to enter or exit positions. The BX Trender’s oscillating values provide insights into whether the market is bullish or bearish, enabling traders to align their strategies accordingly. Finally, the Average Directional Index (ADX) serves as a confirmation tool, validating the strength of a trend. A rising ADX value indicates a robust trend, while a declining value suggests a weak or range-bound market. By combining insights from these three indicators, scalpers can gain a comprehensive view of the cryptocurrency market’s movements, making more informed and strategic trading decisions.

The Secret EMA Cloud: Identifying Trends and Filtering Consolidation

The Secret EMA Cloud is a powerful tool that aids traders in understanding the prevailing trend in the cryptocurrency market and distinguishing it from periods of consolidation. By employing Exponential Moving Averages (EMAs) within a cloud-like formation, this indicator provides valuable insights into the overall direction of price movements. When the price action stays above the cloud, it signals an uptrend, indicating that the market is experiencing a sustained upward movement. On the other hand, when the price remains below the cloud, it suggests a downtrend, indicating a sustained downward movement. By identifying these trends, traders can align their strategies with the prevailing market sentiment, increasing their chances of making profitable trades.

Additionally, the Secret EMA Cloud excels in filtering out consolidation phases, where the market experiences sideways movements and lacks a clear direction. During consolidation, the price may move within a tight range, making it challenging to identify profitable entry and exit points. However, with the help of the EMA Cloud, traders can recognize these periods of low volatility and avoid making trades that could result in minimal gains or losses. By focusing on trending market conditions and avoiding consolidation, traders can enhance their scalping approach, capturing more significant price movements and optimizing their overall trading performance in the fast-paced world of cryptocurrency.

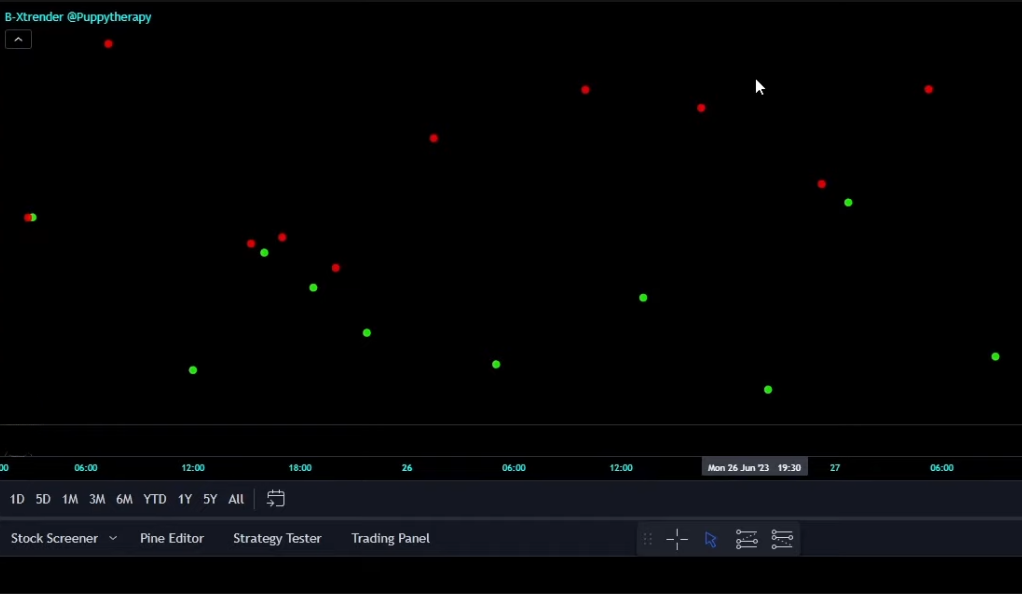

BX Trender: Your Signal for Entry

BX Trender is a critical component of the scalping strategy, serving as a reliable tool for generating entry signals in cryptocurrency trading. This indicator is specifically designed to identify the strength and direction of a trend, assisting traders in making well-timed entries into the market. By analyzing the oscillating values of BX Trender, traders can gain insights into whether the market is currently experiencing a bullish or bearish trend. When the BX Trender value is positive, it suggests a bullish trend, indicating a higher likelihood of the market moving upwards. Conversely, a negative BX Trender value indicates a bearish trend, signaling a higher probability of downward price movements. Armed with this information, traders can make informed decisions about when to initiate trades and align their positions with the prevailing trend, which is crucial for maximizing potential profits.

The BX Trender not only provides entry signals but also helps traders manage risk effectively. By waiting for a confirmation of a strong trend before entering a trade, traders can reduce the likelihood of making premature or ill-timed entries. This cautious approach allows them to avoid entering positions during periods of market uncertainty or consolidation, where price movements may be unpredictable and risk levels may be higher. As a result, BX Trender serves as a valuable tool in a scalper’s arsenal, enabling them to navigate the cryptocurrency market with more confidence and precision, ultimately leading to improved trading outcomes.

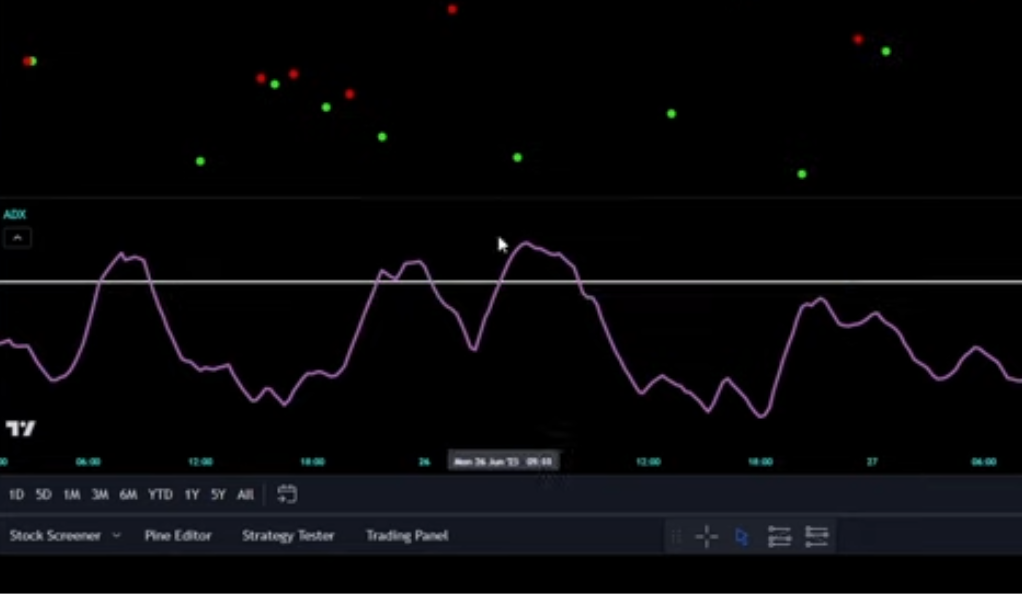

Average Directional Index: Confirming Your Trades

The Average Directional Index (ADX) is a crucial tool for trade confirmation in the scalping strategy. After identifying trends with the Secret EMA Cloud and generating entry signals with BX Trender, traders can turn to the ADX to validate the strength of the identified trend. ADX calculates the strength of a trend, helping traders determine if the market movement is robust enough to support their trade decisions. A rising ADX value indicates a strong and trending market, suggesting that the price is likely to continue moving in the identified direction. This confirmation is particularly valuable for scalpers, as it gives them greater confidence in their trades and reduces the risk of entering positions in weak or range-bound markets.

By utilizing the Average Directional Index, traders can avoid potential false signals and increase the probability of successful trades. If the ADX value is declining or remains low, it indicates a lack of strong trend presence, and the market may be choppy or consolidating. During such periods, entering trades becomes riskier, as price movements may lack clear direction and lead to unpredictable outcomes. The ADX, as a trade confirmation tool, helps scalpers focus on trades that align with prevailing trends and exhibit sufficient momentum, enhancing their overall trading accuracy and improving the likelihood of achieving profitable results in the dynamic and rapidly changing landscape of cryptocurrency trading.

Setting Up Your Indicators and Trading Rules

Setting up the Secret EMA Cloud, BX Trender, and Average Directional Index (ADX) involves using a trading platform that supports these indicators and offers customizable charting tools. Traders can access various charting software or platforms that allow them to add these indicators to their cryptocurrency price charts. For the Secret EMA Cloud, they would need to input the appropriate Exponential Moving Averages with the cloud parameters to create the cloud-like formation. The BX Trender can be added as an oscillating indicator that displays positive and negative values, indicating the strength and direction of the trend. Lastly, the ADX can be included on the chart to visualize the trend’s strength through rising or falling values. Traders should adjust the settings of each indicator based on their preferred timeframes and risk tolerance, as different timeframes may produce varying results.

Once the indicators are set up, traders need to define clear trading rules to apply this scalping strategy effectively. The Secret EMA Cloud’s signals for trend identification can be used as a foundation for the overall market direction. When the price remains above the cloud, traders should consider looking for buying opportunities in the bullish market, and vice versa for a bearish market. The BX Trender’s entry signals can be combined with the Secret EMA Cloud’s trend direction, helping traders pinpoint optimal entry points in line with the prevailing trend. To avoid false signals, traders should focus on entering positions when the ADX confirms a strong trend, providing additional validation. Risk management is critical, and traders should set appropriate stop-loss levels and profit targets for each trade. Furthermore, they must exercise discipline and adhere to their predefined trading rules to ensure consistent and successful application of this scalping strategy in the fast-paced world of cryptocurrency trading.

Conclusion

Scalping is a powerful tool in the arsenal of any cryptocurrency trader. By understanding and effectively using the Secret EMA Cloud, BX Trender, and Average Directional Index, traders can potentially double or triple their account size in just a few weeks. However, like any trading strategy, it requires discipline, patience, and a thorough understanding of the market.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)