The Great Rotation refers to a significant shift in stock market dynamics, influencing investor behavior and asset allocation. It represents a seismic change in the investment landscape, impacting global markets. Understanding this phenomenon is crucial for investors navigating the complexities of the stock market.

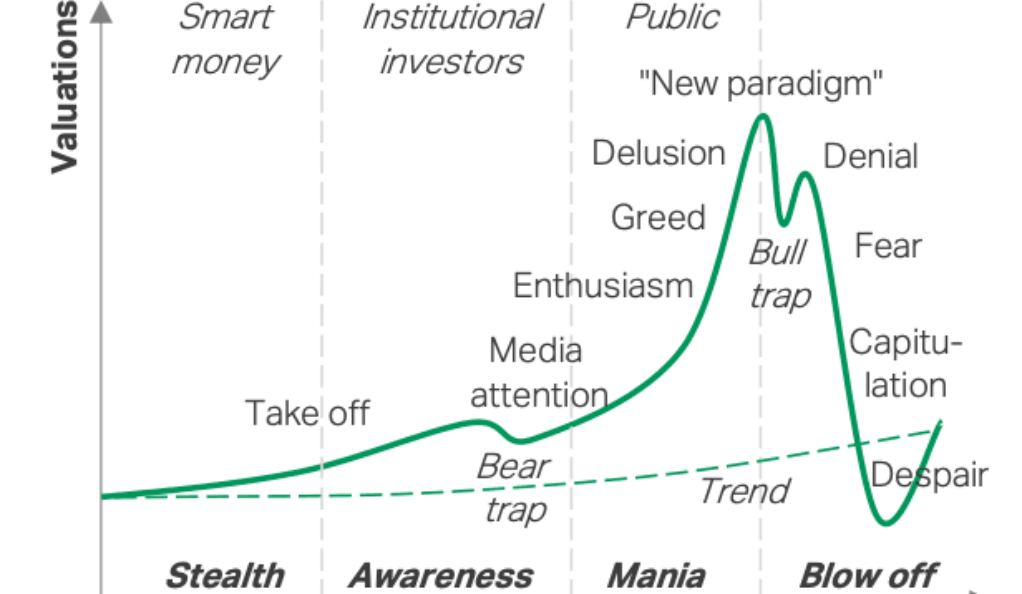

The Great Rotation is characterized by a stock market bubble, where prices significantly exceed intrinsic values. This occurs when stock prices are not supported by fundamental factors such as earnings or book value. Additionally, the global equity scenario has experienced surges in various markets, raising questions about the sustainability of valuations. Divergence between the bond and stock markets adds to the complexity, with the bond market often considered a reliable indicator of economic health. The disconnect between the two markets, particularly due to inflation expectations, can have implications for interest rates and sectors such as commercial real estate.

Moreover, market dynamics play a crucial role, with a shift from mechanically driven markets to technically driven ones potentially leading to sharp market pullbacks. Options trading, a significant aspect of mechanical markets, amplifies short-term market movements. Overall, understanding the Great Rotation and its various components is essential for investors to make informed decisions and navigate the ever-changing world of stocks and shares.

What is “The Great Rotation”?

“The Great Rotation” describes a notable transformation in the dynamics of the stock market, specifically referring to a substantial shift in investor behavior and asset allocation. This phenomenon has profound implications for the overall market and can reshape the investment landscape. It signifies a significant change in how investors allocate their resources and can have both direct and indirect effects on individual investors.

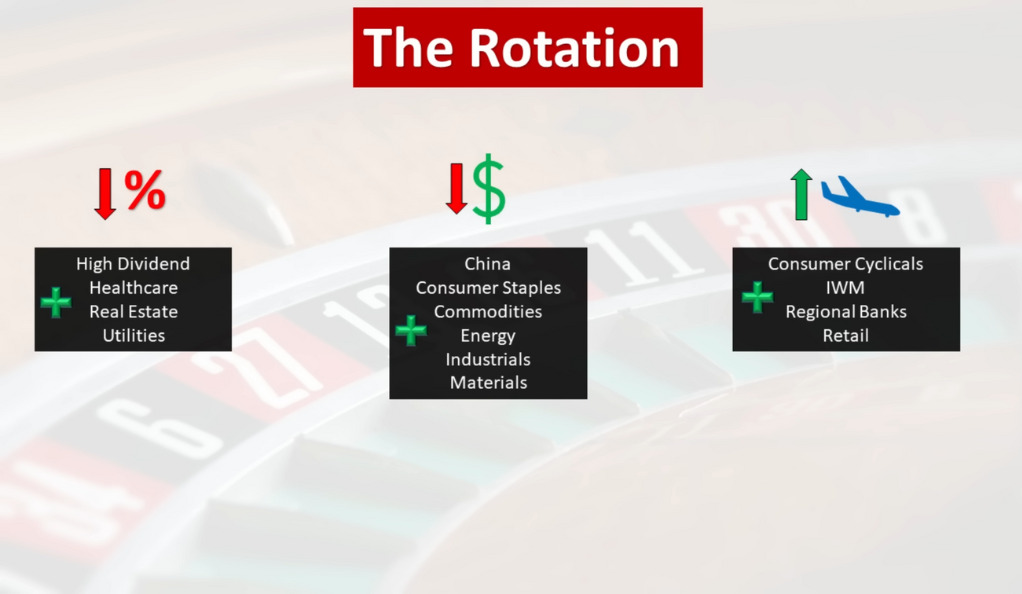

In practical terms, “The Great Rotation” means that investors are reallocating their investments from one asset class to another on a large scale. This reallocation can impact the performance and valuations of different sectors and industries. For example, if investors shift their focus from growth stocks to value stocks, it can lead to a change in market leadership and affect the performance of specific companies or sectors. As an investor, it is important to understand and monitor these shifts to make informed decisions about your own investment strategy and asset allocation.

“The Great Rotation” can also create opportunities and risks for individual investors. On one hand, it opens up the potential for new areas of growth and profit as investors seek out undervalued assets or emerging sectors. On the other hand, sudden shifts in market sentiment and asset allocation can lead to increased market volatility and potential losses. Therefore, staying informed, conducting thorough research, and diversifying your portfolio can help navigate the changing tides of “The Great Rotation” and mitigate risks while capitalizing on potential opportunities.

Understanding the Stock Market Bubble

To understand the concept of the “Great Rotation”, we first need to delve into the notion of a “stock market bubble”. A stock market bubble occurs when the prices of stocks are significantly higher than their intrinsic values. In other words, the prices are not supported by the underlying fundamentals of the companies issuing the stocks, such as earnings, revenues, or asset values.

Currently, there are concerns about the market being in an “IPO Mania” stage, where initial public offerings (IPOs) of companies are being valued at levels that may not be justified by their actual business models or financial performance. For example, we have seen cases where companies in industries traditionally not associated with technology have received valuations comparable to established tech companies. This has raised questions about the sustainability of these evaluations and the market’s overall rationality.

The Global Equity Scenario

While the U.S. market continues to grapple with these dynamics, it’s important to note that international markets are not immune to similar occurrences. Recent surges in stock prices have been observed in various markets around the world, including the German DAX, European equities, Japanese equities, and even Indonesian equities. Some of these price increases have been extraordinary, with the Indonesian market experiencing a staggering rise of a thousand percent, leaving many analysts puzzled.

The Bond Market: A Reliable Lie Detector?

The bond market is often considered a reliable indicator of the overall financial health of an economy. Bonds, being debt securities, reflect investors’ expectations of future economic conditions, inflation, and interest rates. When the bond market and the stock market show divergent trends, it raises concerns among market participants.

Currently, there is a significant divergence between the bond and stock markets, with bond yields indicating a more cautious outlook while stock prices continue to rise. This divergence is considered historic and may be an indication that the stock market is overvalued or disconnected from the underlying economic fundamentals.

The Role of Inflation and Interest Rates

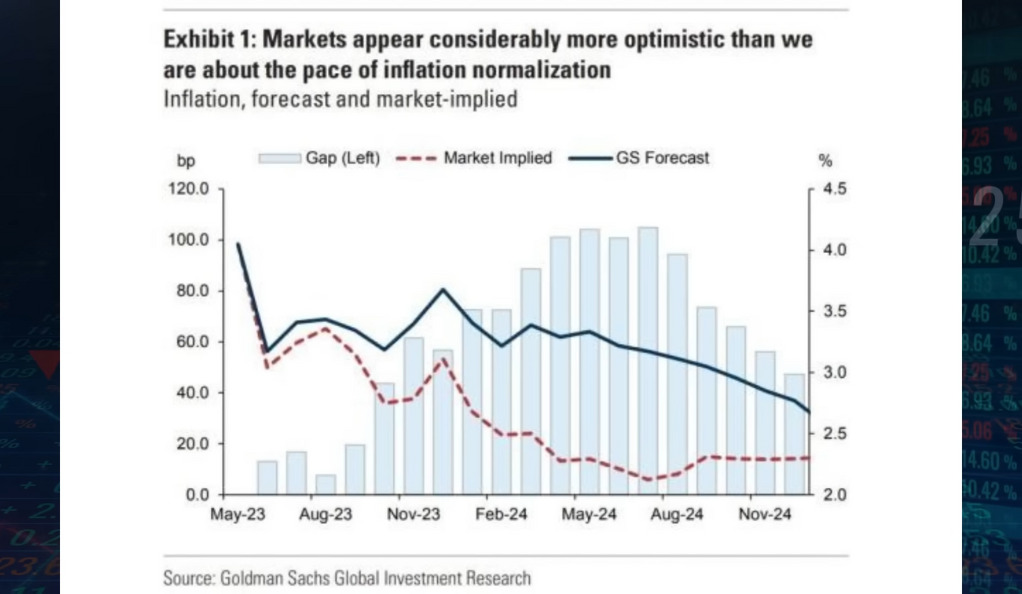

The current disconnect between the stock market and the bond market is attributed by some, including Goldman Sachs, to the expectations of inflation. The markets’ implied inflation outlook is deemed not in touch with reality. If inflation turns out to be higher than expected and persists for a long time, it could lead to prolonged higher interest rates.

Inflation erodes the purchasing power of money and can have a significant impact on investments. Higher inflation expectations can lead to higher interest rates, which in turn can affect the borrowing costs for businesses and individuals. This can impact corporate profitability and consumer spending, ultimately influencing stock market performance.

The Implications of Higher Rates

Higher interest rates are not just an abstract economic concept. They can have tangible impacts on various sectors of the economy. For instance, the commercial real estate sector, which is about to refinance trillions of dollars worth of debt this year, would face a considerable burden with higher rates.

Furthermore, the higher rates could pose a systemic risk due to a large amount of maturing debt. An array of “zombie companies,” struggling firms that can barely cover their debt interest payments, could potentially default on their obligations if rates rise too high. This could have ripple effects throughout the economy and the stock market, leading to increased volatility and potential market downturns.

The Market Dynamics: Fundamentals, Technicals, and Mechanics

When dissecting market dynamics, three elements come into play: fundamentals, technicals, and mechanics. In recent years, the market has been driven by mechanics, followed by technicals, with fundamentals taking the back seat. However, this could change. As we approach an overbought scenario, we might witness a shift from a mechanically driven market to a technically driven one, potentially leading to a sharp pullback in the market.

Fundamentals refer to the underlying financial health and performance of companies, such as earnings, revenue growth, and balance sheet strength. Technicals encompass the analysis of price patterns, trends, and market sentiment. Mechanics involve the influence of various market participants and financial instruments, such as options trading and algorithmic trading.

From Fundamental to Technical: A Paradigm Shift

In the past, the stock market was primarily driven by fundamentals. Investors focused on factors such as company earnings, economic indicators, and the Federal Reserve’s monetary policy. However, in recent years, the market dynamics have shifted towards being led by mechanics and technical factors.

Mechanics-driven markets, such as those heavily influenced by options trading, can be characterized by heightened volatility and short-term price movements that may not necessarily align with the underlying fundamentals. Technical factors, such as chart patterns and trend analysis, have gained prominence as more traders rely on algorithms and quantitative models to make investment decisions.

In the current scenario, as the market reaches overbought conditions (a technical term indicating that an asset is being excessively bought), a shift back to a technical market could be imminent. This shift could lead to a pullback or a correction in the market as traders and investors reassess their positions based on technical indicators rather than just fundamentals.

A Mechanical Market: The Role of Options

In a mechanical market, options play a significant role. Options are financial instruments that provide the right to buy or sell an underlying asset at a specific price within a predetermined period. They can be highly impulsive, defying odds and expectations, but they also have an expiration date, which often leads to a sharp pullback or reversion to the mean.

Options trading can amplify market movements, as traders use leverage and complex strategies to profit from short-term price swings. This type of market can be exhilarating for the daring investor, but it is important to note that such markets are typically short-lived due to the expiration date on options. As these expiration dates approach, the market could revert back to being driven by technical factors, such as chart patterns and trend analysis.

Conclusion

In conclusion, the financial world is an ever-changing landscape, with the “Great Rotation” being the latest phenomenon to grip the global markets. Amidst the whirlwind of IPO manias, diverging bond and stock markets, inflationary pressures, and shifting market dynamics, the only certainty is uncertainty.

As investors, it’s important to stay informed about these trends, understand their potential impacts, and navigate the financial waters with a clear understanding and a well-thought-out strategy. The road ahead may be bumpy, and while the market’s direction can never be predicted with absolute certainty, being prepared for all possibilities can help you weather any storm.

Keeping a close eye on market developments, analyzing the fundamentals and technicals, and adjusting your investment strategy accordingly can help you navigate the great rotation and position yourself for long-term success. Remember, the best investors are not those who can predict the future, but those who are best prepared for it.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)