UK’s current economic landscape. If you’ve been following the news lately, you know that the UK is facing a series of complex challenges that are making headlines around the world. From blocked tech acquisitions to alarming inflation rates, wage struggles, and the underperformance of UK equities, there’s a lot to unpack.

But wait, there’s more! We’ll also take a lighter look at President Joe Biden’s recent visit to the UK, filled with humorous moments that provided a welcome break from the often serious world of politics.

Why should you care about all this? Well, the UK’s economic challenges are not just a local issue. They have far-reaching implications for the global economy and provide valuable insights into broader economic trends and policies. Whether you’re an investor, a policy enthusiast, a student of economics, or just curious about what’s happening in the world, this exploration will offer you valuable insights.

So grab a cuppa, settle into your favorite chair, and let’s dive right in! We’ll explore each topic in detail, breaking down complex issues into understandable terms, and sprinkling in some humor along the way. Ready to embark on this exciting journey? Let’s get started!

Microsoft’s Blocked Acquisition: A Shock to the System

The recent decision by UK regulators to block Microsoft’s acquisition sent shockwaves through the tech industry. This unexpected move has raised eyebrows and questions about the future of tech mergers and the role of government in shaping the industry. The ripple effect didn’t stop at Microsoft; it also impacted Activision Blizzard’s stock, causing volatility and uncertainty among investors. This incident serves as a stark reminder that even tech giants are not immune to regulatory surprises and underscores the complex interplay of regulatory compliance, competition laws, and national interests in the world of acquisitions.

The Unexpected Turn of Events

When UK regulators decided to block Microsoft’s acquisition, it was like a sudden thunderstorm on a clear day. This decision was unexpected and left many in the tech industry scratching their heads. Why would the UK take such a drastic step? The answer lies in the complex world of mergers and acquisitions, where regulatory compliance, competition laws, and national interests intertwine. This decision has set a precedent, raising questions about future tech acquisitions and the role of government in shaping the industry landscape.

The Ripple Effect on Activision Blizzard’s Stock

The shockwaves from the blocked acquisition didn’t stop at Microsoft. Activision Blizzard’s stock felt the tremors too. Imagine building a house of cards, only to have someone open a window, causing it to tumble. That’s what happened to Activision Blizzard’s stock. Investors were left scrambling, trying to understand the implications. The uncertainty surrounding the deal has led to volatility in the stock, reflecting broader concerns about regulatory interventions in the tech sector. This incident serves as a stark reminder that even giants like Microsoft and Activision Blizzard are not immune to regulatory surprises.

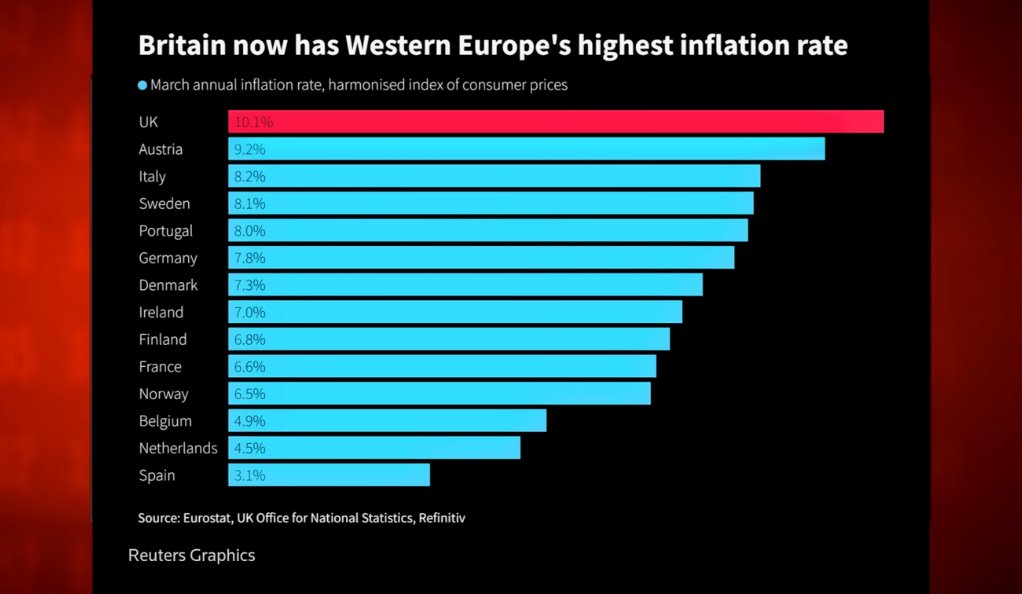

Inflation in the UK: A Warning Bell for the Global Economy?

Inflation in the UK has reached alarming levels, sounding a potential warning bell for the global economy. Driven by various factors such as supply chain disruptions, increased demand, and government spending, the UK’s rising inflation rate is a cautionary tale for other economies. The persistence of high inflation is eroding purchasing power and causing distress among consumers, leading to wage struggles and social unrest. The UK’s experience with inflation highlights the importance of careful monetary policies and fiscal responsibility and serves as a stark reminder of the potential global implications if left unchecked.

The Rise of Inflation

Inflation in the UK is like a balloon that keeps inflating, and no one knows when it will pop. It’s reached alarming levels, causing concern not just in the UK but globally. The rise in inflation is driven by various factors, including supply chain disruptions, increased demand, and government spending. The UK’s experience serves as a cautionary tale for other economies, highlighting the need for careful monetary policies and fiscal responsibility. If left unchecked, inflation can erode purchasing power, disrupt markets, and lead to social unrest.

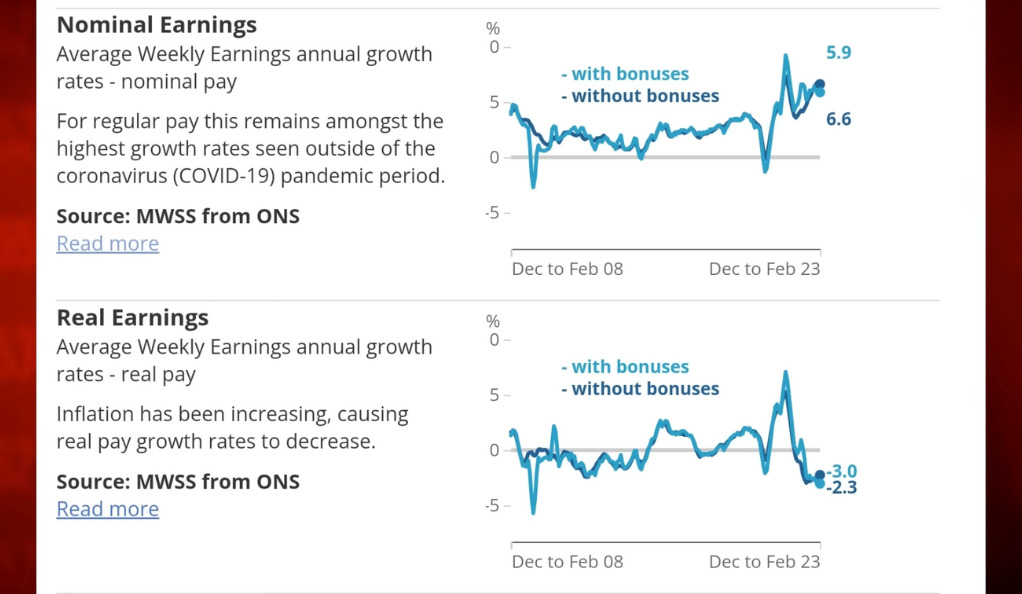

The Impact on Wages and the Working Class

High inflation rates in the UK are like a relentless tide eroding the shores of workers’ wages. Despite efforts to increase pay, the rising cost of living is outpacing wage growth. Strikes and demands for better pay are becoming more common, reflecting the frustration of the working class. The struggle for fair wages is a complex issue, involving labor laws, corporate practices, and economic policies. The UK’s wage struggles serve as a window into the broader challenges of maintaining social equity in a rapidly changing economic landscape.

President Joe Biden’s UK Visit: A Lighter Take

President Joe Biden’s recent visit to the UK was filled with unexpected and humorous moments that captured the attention of both the media and the public. From an unanticipated shove of the Prime Minister to a salute to a military officer, and even rumors about asking to meet Queen Victoria from the 1800s, the trip was anything but ordinary. These light-hearted incidents provided a refreshing break from the often serious world of international diplomacy and politics, reminding us that even world leaders can have quirky, human moments that resonate with people everywhere.

The Arrival and the “Shove”

President Joe Biden’s recent visit to the UK was filled with moments that seemed straight out of a comedy sketch. From his unexpected shove of the Prime Minister to his salute to a military officer, the trip was anything but ordinary. And the rumours about him asking to meet Queen Victoria from the 1800s? That’s the cherry on top of a humorous sundae. These light-hearted moments provide a welcome respite from the often serious world of politics and diplomacy. They remind us that even world leaders can have quirky, human moments.

The UK’s Economic Challenges: A Deep Dive

The Struggle with High Inflation Rates

Inflation in the UK is like a stubborn weed that keeps growing back, no matter how many times you try to pull it out. It’s affecting everything from food prices to household services, causing distress for consumers. The government and the Bank of England are grappling with ways to tame this inflation beast, but it’s proving to be a formidable challenge. The persistence of high inflation underscores the complexity of economic management and the delicate balance required to maintain stability.

Wage Struggles and Strikes

The UK’s wage struggles are like a tug-of-war between workers and employers, with neither side willing to let go. Strikes and demands for better pay are on the rise, reflecting a growing discontent among the working class. The situation is exacerbated by inflation, which is eroding real wages. The government, unions, and employers must find common ground to address these challenges. The ongoing wage struggles highlight the importance of fair labor practices and the need for a comprehensive approach to economic well-being.

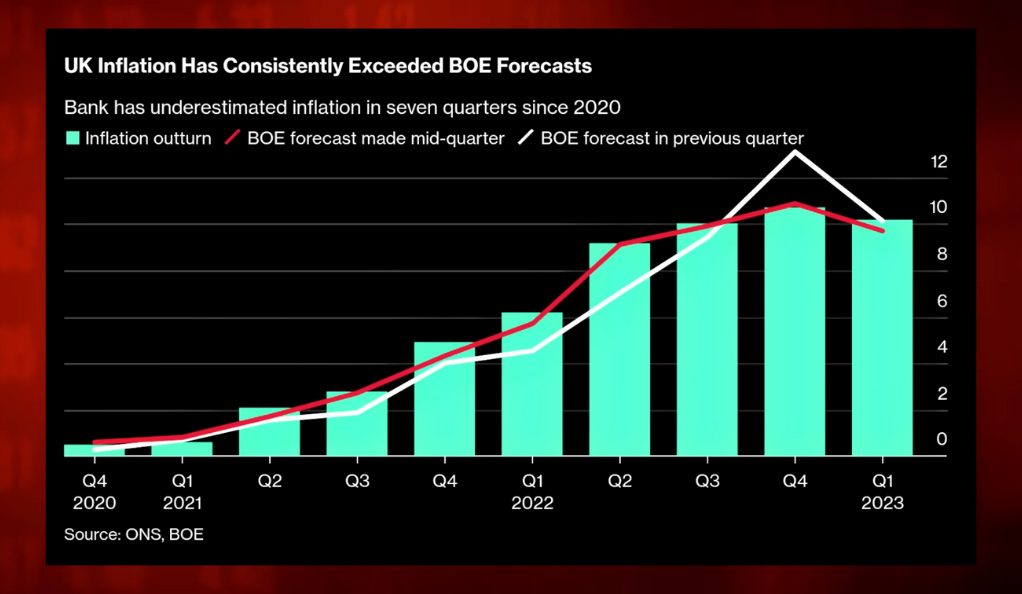

The Bank of England’s Interest Rate Policies: A Balancing Act

The Need to Raise Interest Rates

The Bank of England’s interest rate policies are like a high-wire act, where one misstep can lead to a fall. The need to raise interest rates to combat inflation is clear, but the timing and magnitude of these increases are fraught with challenges. Raise them too quickly, and the economy could stumble; too slowly, and inflation could spiral out of control. The Bank of England’s approach to interest rates reflects the broader challenges of central banking in a complex and interconnected global economy.

UK Equities: The Underdogs of the Global Market

The Lagging Performance

UK equities are like a talented athlete who’s lost their edge, lagging behind their global peers. The underperformance is driven by various factors, including economic uncertainty, regulatory challenges, and investor sentiment. The UK market’s struggles are emblematic of the broader challenges facing mature economies, grappling with technological disruption, political uncertainty, and global competition.

Lack of Confidence by Global Investors

Global investors’ lack of confidence in the UK market is like a fading star that’s lost its sparkle. Concerns about economic stability, regulatory interventions, and political uncertainty have led to a decline in investor interest. Restoring confidence requires concerted efforts by the government, regulators, and businesses to create a favorable investment climate. The UK’s experience serves as a lesson for other markets, highlighting the importance of transparency, stability, and sound economic policies.

Conclusion

So there you have it, a whirlwind tour of the UK’s economic landscape. From blocked acquisitions to inflation woes, the UK is navigating a storm that has global implications. Will the Bank of England’s policies be enough to steer the ship to safety? Can the UK regain the confidence of global investors? Only time will tell.

But one thing’s for sure: the UK’s economic challenges are a complex puzzle that requires careful handling. It’s like trying to complete a jigsaw puzzle with pieces that keep changing shape. The world is watching, and the decisions made today will shape the economic landscape for years to come.

So, what do you think? Is the UK on the brink of an economic disaster, or is there a way out of this maze? Share your thoughts, and let’s keep the conversation going!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)