In the fast-paced realm of cryptocurrency trading, where split-second decisions can spell the difference between profit and loss, traders are continuously seeking strategies that offer an edge. Scalping has emerged as a popular technique, and one specific scalping strategy is gaining attention due to its purportedly high win rate of 74%. The strategy involves making numerous trades throughout the day, aiming to profit from small price movements in cryptocurrencies. While the potential for quick profits is alluring, it’s important for traders to exercise caution and conduct thorough research before adopting any strategy, as the cryptocurrency market can be highly volatile and unpredictable.

This particular scalping approach typically involves using technical analysis, short-term charts, and tight stop-loss orders to capitalize on short-lived price fluctuations. While the claimed win rate may seem enticing, traders must remember that no strategy is foolproof, and success in cryptocurrency trading demands a comprehensive understanding of market trends, risk management, and discipline. Additionally, scalping may not be suitable for all traders, as it requires quick decision-making, constant monitoring of the markets, and the ability to execute trades swiftly. As with any trading strategy, traders are advised to practice with small amounts and assess its performance before committing significant capital. Overall, while the allure of high win rates is enticing, careful evaluation and adaptability are essential in navigating the ever-changing cryptocurrency landscape.

Understanding Scalping in Crypto Trading

Scalping in crypto trading is akin to being a vigilant hawk, always on the lookout for quick opportunities to seize small profits from fleeting price movements. Traders employing this strategy closely monitor short-term charts and utilize technical analysis tools to identify potential entry and exit points. By capitalizing on even the smallest price fluctuations, scalpers aim to accumulate profits throughout the day. This fast-paced approach requires precision timing and the ability to swiftly execute trades, as the profit margins per trade may be slim.

However, scalping comes with its own set of challenges and risks. The frequent trading incurs higher transaction costs due to multiple trades, and even a small mistake can lead to losses. Additionally, scalping demands substantial focus and dedication, as traders need to stay consistently active and aware of the market. The strategy may not be suitable for everyone, as it requires a certain temperament and experience to handle the pressure of rapid decision-making. Moreover, in the highly volatile crypto market, sudden price swings can lead to significant losses if not managed effectively. As with any trading strategy, it’s crucial for traders to carefully assess their risk tolerance, conduct thorough research, and employ strict risk management techniques to enhance their chances of success in scalping.

The Three Pillars of the Strategy

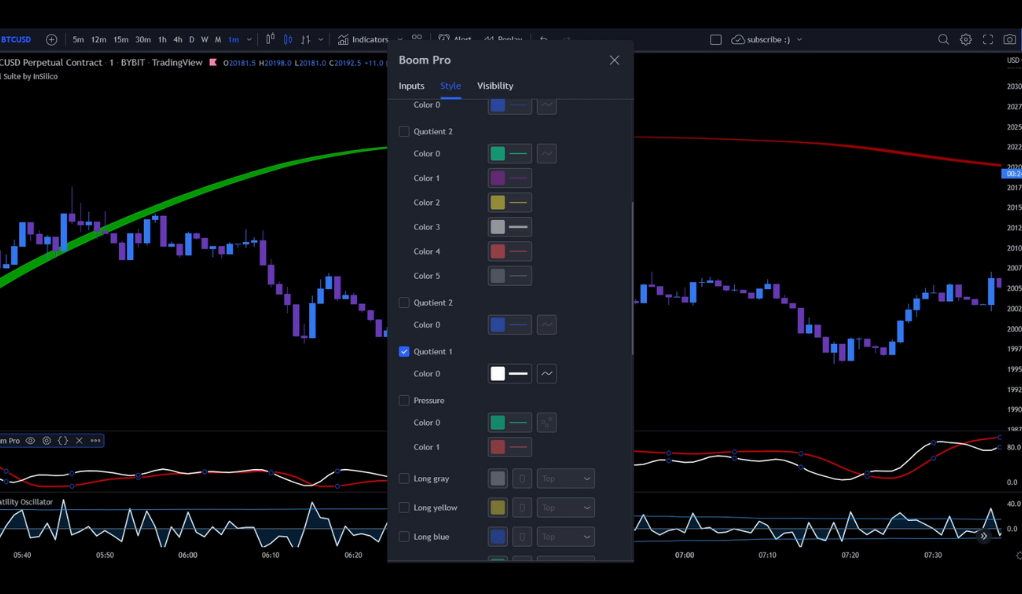

The foundation of this specific scalping strategy relies on three key indicators: the Whole Suite, Boo Hunter Pro, and Volatility Oscillator. Together, these indicators serve as essential compasses, guiding traders through the unpredictable and turbulent waters of the cryptocurrency market. The Whole Suite provides a comprehensive set of tools and analysis to identify potential trading opportunities, Boo Hunter Pro offers insights into market sentiment and momentum, while the Volatility Oscillator helps gauge the market’s volatility and potential price movements. By leveraging the power of these three pillars, traders can make more informed and calculated decisions as they aim to capitalize on small price changes in the fast-paced world of crypto trading.

Hull Suite

The Hull Suite serves as a comprehensive tool, akin to the captain of a ship, guiding traders in the right direction by offering a broad view of market trends. This powerful tool equips traders with valuable insights and analysis, allowing them to navigate the complex cryptocurrency market with greater clarity and understanding. By consolidating various market indicators and data, the Whole Suite aids traders in making well-informed decisions, identifying potential opportunities, and managing risks effectively. Just as a skilled captain steers a ship through challenging waters, the Whole Suite empowers traders to navigate the ups and downs of the crypto market with confidence and precision.

Boo Hunter Pro

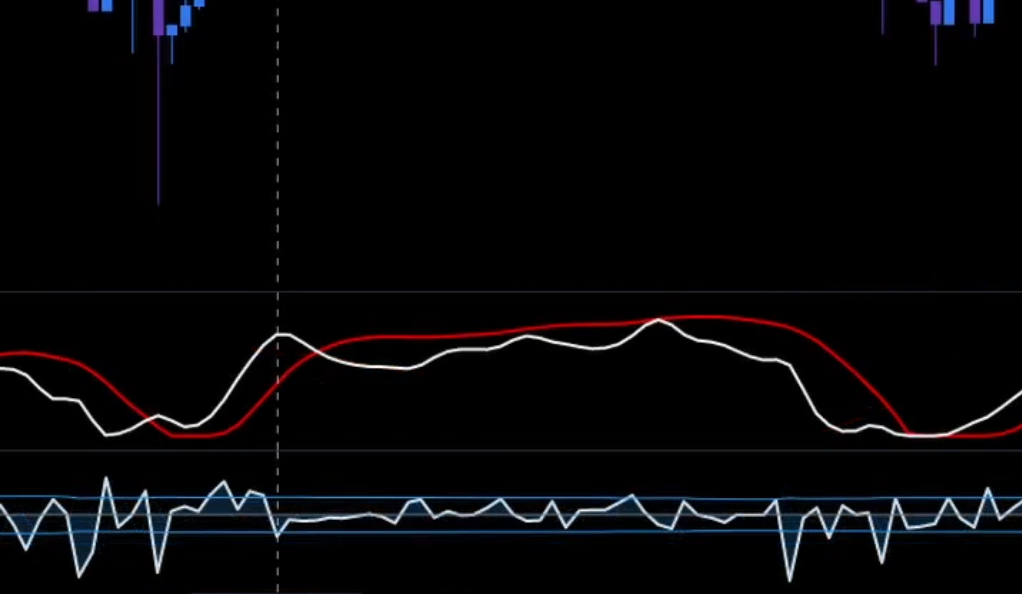

Boo Hunter Pro plays the role of a sharp-eyed lookout in this scalping strategy, skillfully spotting potential profitable trades amidst the vast sea of market data. Just as a lookout on a ship’s mast scans the horizon for any signs of opportunity or danger, Boo Hunter Pro diligently monitors market sentiment, momentum, and key indicators to identify favorable trade setups. By swiftly detecting emerging trends and changes in market dynamics, this tool provides traders with timely alerts and valuable insights, enhancing their ability to capitalize on fleeting opportunities in the ever-changing cryptocurrency landscape. As a vital component of the strategy, Boo Hunter Pro’s vigilance ensures that traders can stay ahead of the game and make informed decisions to maximize their chances of success in the fast-paced world of crypto trading.

Volatility Oscillator

The Volatility Oscillator serves as the wind in the sails of this scalping strategy, providing crucial information about the strength and direction of market trends. Similar to how wind power propels a sailing ship forward, this indicator offers traders insights into the level of market volatility and the potential price movements ahead. By gauging the intensity of market fluctuations, traders can better assess the risk associated with their trades and adjust their strategies accordingly. The Volatility Oscillator’s ability to highlight periods of increased price action empowers traders to make timely decisions, capturing opportunities during periods of heightened activity and potentially avoiding unfavorable market conditions. As a guiding force in the strategy, the Volatility Oscillator helps traders steer their course and navigate the crypto market’s ever-changing currents with greater precision and confidence.

Navigating the One-Minute Timeframe

Operating on the one-minute timeframe of the Bitcoin chart is akin to navigating through a bustling city during rush hour – everything moves rapidly, and traders need to be exceptionally quick and agile. In this fast-paced environment, price movements can be swift and unpredictable, requiring traders to make split-second decisions. The one-minute timeframe provides a granular view of the market, allowing traders to spot micro-trends and capitalize on short-lived opportunities. However, it also amplifies the impact of noise and market fluctuations, making it crucial for traders to stay focused and maintain a disciplined approach. Success in this timeframe heavily relies on the ability to swiftly execute trades, effectively manage risk, and interpret the three key indicators – the Whole Suite, Boo Hunter Pro, and Volatility Oscillator – with precision.

While the one-minute timeframe can offer the potential for quick profits, it comes with inherent risks and challenges. The rapid pace of trading may lead to increased transaction costs due to frequent trades, and emotions can play a significant role as traders face constant market fluctuations. Maintaining a clear and composed mindset is crucial in such a high-pressure environment. Additionally, traders must be mindful of market liquidity and slippage, as executing trades at a fast pace can impact their overall profitability. Overall, navigating the one-minute timeframe in Bitcoin trading requires a unique skill set, strong discipline, and the ability to adapt swiftly to changing market conditions. Traders must thoroughly test and refine their strategies to find the right balance between speed and accuracy to make the most of this fast-moving market.

Entry and Exit Rules

In this scalping strategy, timing is everything, much like knowing when to jump into a skipping rope. Traders must have precise entry and exit rules based on signals from the Whole Suite, Boo Hunter Pro, and Volatility Oscillator. Swift decision-making and discipline are crucial for success in this fast-paced crypto trading approach.

Long Positions

When it comes to long positions, the strategy provides traders with clear and specific entry and exit rules, akin to a treasure map leading them to the X that marks the spot. Traders following this approach will have predetermined criteria, likely derived from the Whole Suite, Boo Hunter Pro, and Volatility Oscillator, to identify favorable points to enter a long position. These criteria may include technical indicators, price levels, or market sentiment signals indicating potential upward trends. Similarly, the strategy will guide traders on when to exit the long position, either by hitting a predefined profit target or implementing a stop-loss order to protect against potential losses. By adhering to these well-defined rules, traders can navigate the complexities of long positions with greater confidence, increasing their chances of uncovering profitable opportunities amidst the dynamic and ever-changing cryptocurrency market.

Short Positions

For short positions, the strategy offers traders detailed instructions, resembling a recipe that guides them step-by-step towards a successful trade. Traders following this approach will have specific criteria, likely derived from the Whole Suite, Boo Hunter Pro, and Volatility Oscillator, to identify optimal entry points for short positions. These criteria may encompass technical indicators, price levels, or market sentiment signals pointing to potential downward trends. Likewise, the strategy will provide guidance on when to exit the short position, whether by hitting a predefined profit target or implementing a stop-loss order to manage potential risks. By adhering closely to these well-defined instructions, traders can navigate the intricacies of short positions with greater precision, enhancing their ability to capitalize on profit opportunities within the dynamic and ever-changing cryptocurrency market.

Risk Management: The Safety Net

In this trading strategy, risk management plays a crucial role as the safety net that protects against potential losses. Emphasizing the importance of prudent risk management, the strategy recommends risking only 2% of the trading account for each trade. This approach is akin to wearing a seatbelt while driving – it may not prevent accidents from occurring, but it can significantly reduce the damage caused by adverse market movements. By adhering to the 2% risk per trade rule, traders can safeguard their capital and ensure that a series of unfavorable trades does not wipe out their account. A disciplined risk management strategy is fundamental in preserving trading capital, enhancing longevity in the market, and ultimately improving the overall chances of success in the challenging and dynamic world of cryptocurrency trading.

Conclusion

In the volatile world of crypto trading, a reliable strategy is a trader’s best friend. This scalping strategy, with its high win rate and clear guidelines, can be a valuable tool in a trader’s arsenal. However, like any strategy, it’s not foolproof. It’s essential to understand the strategy thoroughly and adapt it to one’s trading style and risk tolerance. Remember, in trading, there’s no one-size-fits-all solution. Happy trading!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)