Cryptocurrency trading has undoubtedly captured the attention of investors worldwide, presenting abundant opportunities for profit. However, to navigate the volatile and fast-paced market successfully, a strategic approach supported by robust trading strategies is essential.

The key to this strategy lies in a combination of technical analysis and risk management. Traders using this approach focus on identifying well-defined entry and exit points based on market trends and price action. By carefully studying historical price data, chart patterns, and various indicators, they aim to spot potential opportunities with favorable risk-reward ratios. Additionally, risk management plays a crucial role in this strategy. Traders implement stop-loss orders and position sizing techniques to protect their capital and limit potential losses during adverse market movements. This disciplined approach ensures that traders can stay in the game for the long term, capitalizing on profitable opportunities while managing potential risks effectively.

The TradeIQ Strategy: An Overview

The TradeIQ strategy has garnered attention for its promising performance, particularly when initially backtested on Ethereum. With a notable 69% win rate and an impressive profit and loss (PnL) of 128%, the strategy has demonstrated its potential for success in the cryptocurrency market. This high win rate suggests that the strategy’s approach of leveraging technical analysis and risk management has been effective in identifying profitable trading opportunities on Ethereum.

The Three Pillars: QQE MOD, SSL Hybrid, and Waddah Attar Explosion

The TradeIQ strategy incorporates three essential indicators – QQE MOD, SSL Hybrid, and Waddah Attar Explosion – to determine price direction and facilitate entry at optimal prices. Setting up these indicators involves configuring their parameters to suit the trader’s preferences and market conditions. The QQE MOD indicator helps identify trend strength and potential reversal points, while the SSL Hybrid indicator combines moving averages to signal trend changes. Lastly, the Waddah Attar Explosion indicator focuses on market momentum. By carefully adjusting the settings of these indicators and understanding their interpretations, traders can effectively apply the TradeIQ strategy to make informed trading decisions and potentially capitalize on profitable opportunities in the cryptocurrency market.

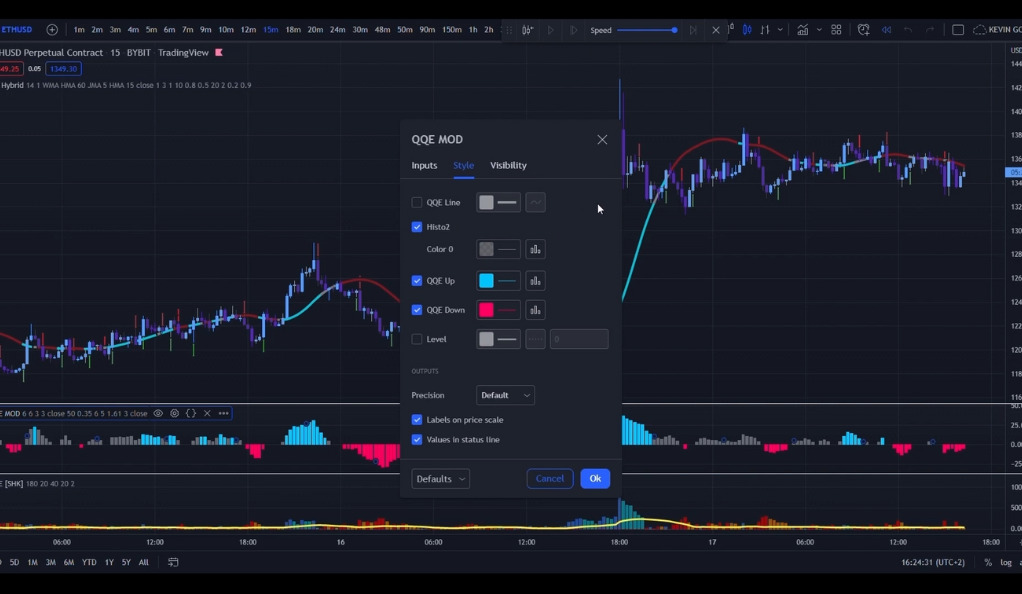

QQE MOD

QQE MOD, which stands for Quantitative and Qualitative Monetary Easing with a Negative Interest Rate Policy, is an unconventional monetary policy implemented by the Bank of Japan. It was introduced as a response to deflationary pressures and slow economic growth in the country. QQE MOD combines both quantitative easing measures, involving the massive purchase of financial assets, and qualitative easing, which targets the quality and risk profile of these assets. Additionally, a negative interest rate policy is employed, where financial institutions are charged for keeping excess reserves with the central bank. By implementing QQE MOD, the Bank of Japan aims to boost consumer spending, encourage investment, and stimulate inflation to achieve its target of stable and sustainable economic growth. However, like all monetary policies, its effectiveness and potential side effects are subjects of ongoing debate and analysis.

SSL Hybrid

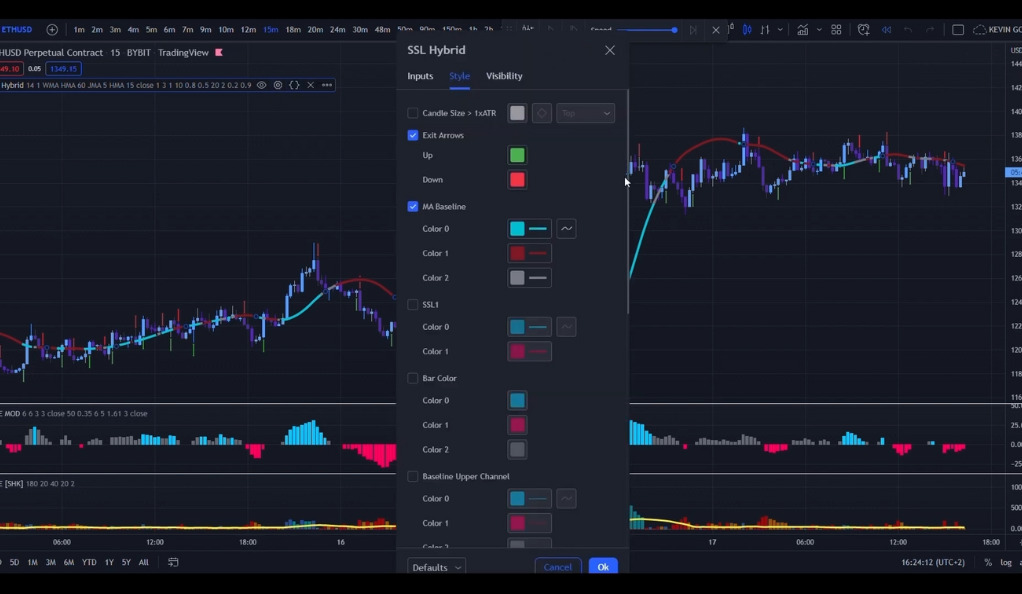

SSL hybrid, also known as Hybrid SSL, is a cybersecurity solution that combines the benefits of both SSL (Secure Sockets Layer) inspection and SSL decryption. SSL is a standard encryption protocol that ensures secure communication between a user’s web browser and a website, protecting sensitive data from potential attackers. However, this encryption can also be exploited by malicious actors to hide their activities from security measures. SSL hybrid resolves this issue by employing both SSL inspection, which allows security devices to monitor encrypted traffic for threats, and SSL decryption, which decrypts the traffic for deeper analysis. By utilizing this hybrid approach, organizations can strike a balance between security and privacy, ensuring the protection of sensitive information while maintaining the ability to identify and prevent potential cyber threats.

Setting Up the Indicators

The TradeIQ strategy setup involves three key indicators: SSL Hybrid by Mihkel00, QQE Mod by Mihkel00, and Waddah Attar Explosion V2 by Shayankm. Firstly, activate the SSL Hybrid indicator and customize it to display only the Exit Arrows and the MA Baseline. Next, configure the QQE Mod indicator by adjusting the RSI Smoothing to 6 and turning off the QQE Line and the Level. Finally, activate the Waddah Attar Explosion V2 indicator and fine-tune the Sensitivity to 180, disable the Dead Zone Line, and set the Explosion Line color to yellow. Additionally, set the Uptrend Colors to blue.

These indicators work in synergy to help traders identify price trends, potential reversals, and market momentum, which are crucial factors for making informed trading decisions. However, it is essential to remember that no trading strategy is foolproof, and the cryptocurrency market can be highly volatile and unpredictable. Traders should continuously monitor market conditions, stay updated with relevant news and events, and be prepared to adjust their settings or strategy if needed. By practicing caution and discipline, traders can maximize the potential of the TradeIQ strategy and improve their chances of achieving profitable results in the dynamic world of cryptocurrency trading.

Rules for a Long Position

Once the indicators are properly set up, traders can proceed to understand the rules for taking a long position in the TradeIQ strategy. The first condition is that the SSL Line must be blue, indicating a favorable bullish trend. Additionally, the Price Action should be above the blue SSL Line, confirming the upward momentum in the market. Moreover, a blue Histogram on the QQE Mod Indicator further validates the bullish sentiment. Lastly, traders should ensure that the WAE Volume Indicator is blue and positioned above the Yellow Line, indicating increased buying pressure.

Rules for a Short Position

The rules for a short position in the TradeIQ strategy mirror those for a long position, but with colors and positions reversed. In a short trade, the SSL Line should be red, indicating a bearish trend. The Price Action must be below the red SSL Line, confirming the downward momentum. The QQE Mod Indicator should display a red Histogram, further supporting the bearish sentiment. Additionally, traders should observe the WAE Volume Indicator, which should be red and positioned below the Yellow Line, signifying increased selling pressure. It is essential to wait for all these signals to align with a closed candle before entering a short trade and to place the Stop Loss above the last Swing High to manage risk effectively. Exit the short position when a green Arrow appears while the trade is in profit, but avoid exiting if the trade is in a loss until market conditions support a potential reversal. Following these rules allows traders to make informed decisions while taking short positions using the TradeIQ strategy.

Backtesting and Reality Check

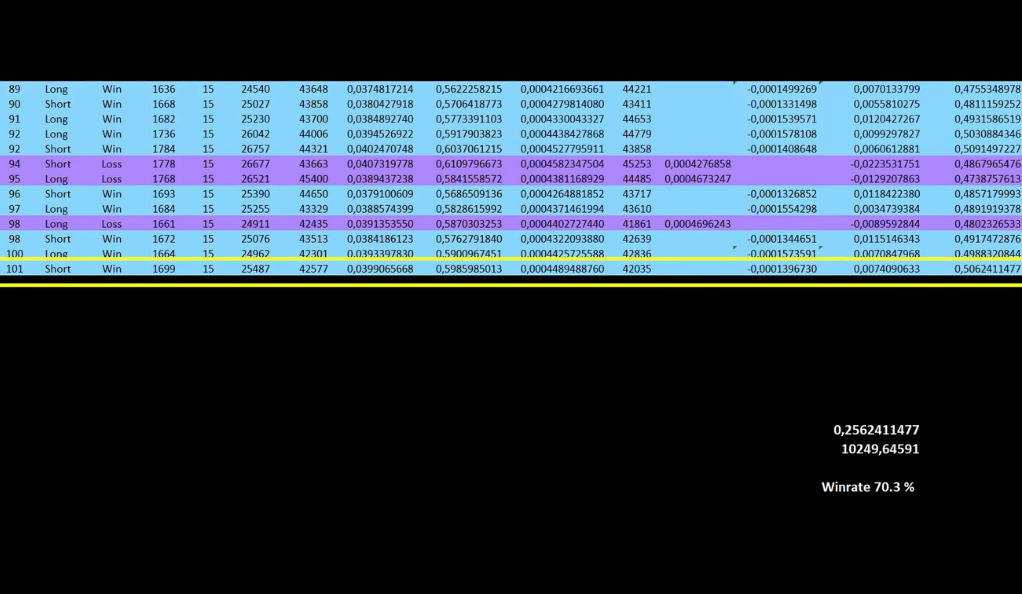

Once the rules of the TradeIQ strategy have been thoroughly understood, the next crucial step is backtesting, which involves applying the strategy to historical market data to assess its performance. In this case, the backtesting process spanned over a period of 42 days and encompassed a total of 101 trades. The results of the backtesting were indeed quite promising, suggesting that the TradeIQ strategy has demonstrated the potential to identify profitable trading opportunities and effectively capture market trends during the testing period.

However, it is essential to exercise caution and interpret the backtesting results with a critical eye. While backtesting can provide valuable insights into the strategy’s historical performance, real-world trading conditions can significantly differ from past data. Market dynamics can change rapidly, and unforeseen events can influence cryptocurrency prices unpredictably. Therefore, it is crucial to remember that backtesting is not a guarantee of future success and that traders should be prepared to adapt their strategies based on the current market conditions. Regularly evaluating the strategy’s performance and making necessary adjustments can enhance its efficacy and increase the likelihood of consistent success in live trading.

The Results

The recorded backtesting results of the TradeIQ strategy were documented in an Excel worksheet, showcasing impressive performance over the 42-day testing period. Starting with an initial account size of 0.25 Bitcoin, the strategy successfully doubled the account size through 101 executed trades. With a notable win rate of 70%, the TradeIQ strategy exhibited a keen ability to identify profitable trading opportunities in the cryptocurrency market. Considering an average price of 40,000 USD per Bitcoin during the testing period, the strategy yielded a significant profit of 10,249 USD, highlighting its potential for generating substantial returns for savvy traders.

While the backtesting results are undoubtedly encouraging, it is crucial to maintain a cautious approach when applying the strategy to real-world trading. Market conditions can change rapidly, and past performance does not guarantee future success. Traders should carefully monitor the strategy’s performance in live trading, adhere to risk management principles, and stay updated with current market trends. By combining the valuable insights gained from backtesting with diligent risk management and a disciplined approach, traders can increase their chances of success and further capitalize on the potential of the TradeIQ strategy in the dynamic and ever-evolving world of cryptocurrency trading.

Conclusion

Cryptocurrency trading can be a lucrative venture if approached with the right strategy. The TradeIQ strategy, with its impressive win rate and potential for high returns, is a testament to this. However, like any investment, it’s essential to understand the rules and backtest the strategy before diving in. With careful planning and strategic execution, the world of cryptocurrency trading can indeed be a gold mine. Happy trading!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)