Hey there, fellow investor! Welcome to the world of finance, where numbers tell stories, and trends shape futures. In this fast-paced, ever-changing landscape, understanding the intricacies of the market is key. Whether you’re a seasoned trader or just starting your investment journey, there’s always something new to learn and explore.

In this comprehensive analysis, we’ll explore everything from operating margins to trading strategies. We’ll delve into the nitty-gritty of earnings reports, market trends, and investment banks. With insights, analysis, and a touch of human perspective, we’ll guide you through the financial maze. So, buckle up, grab a cup of coffee, and let’s embark on this exciting journey through the financial landscape!

Operating Margins and Net Income Analysis: A Deep Dive

The Decline of Operating Margins

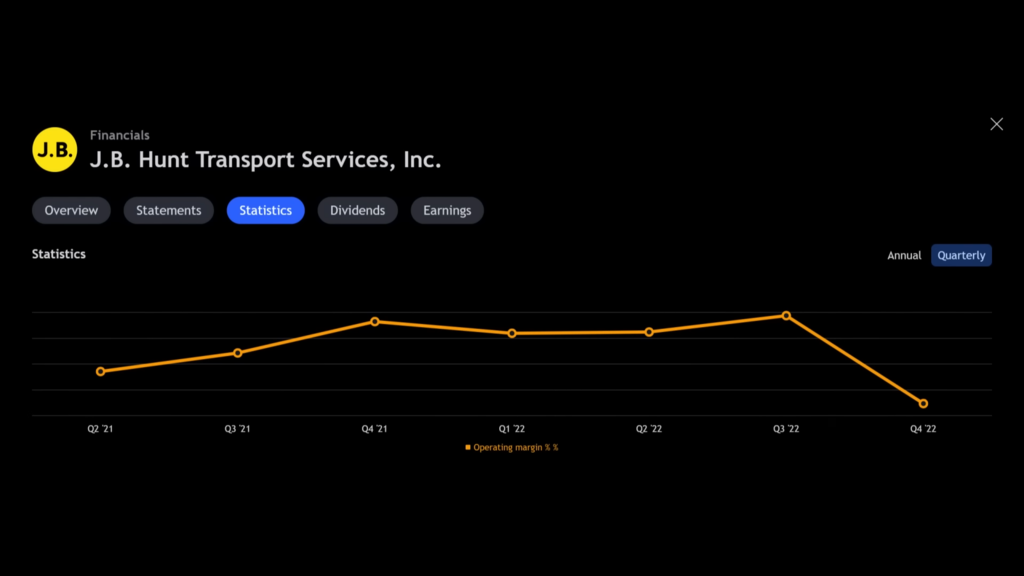

Operating margins are like the heartbeat of a company, and when they decline, it’s a sign of trouble. In our analysis, we found a staggering year-on-year decrease of 91%. What’s causing this? Is it a one-time hiccup or a sign of underlying issues? These are questions that analysts and investors must grapple with. The decline in operating margins can have far-reaching implications, affecting everything from investor confidence to future growth prospects.

Net Income: A Quarter-Over-Quarter Disaster

Net income is another vital sign of a company’s health. A 96% quarter-over-quarter decline is more than alarming; it’s a red flag. This decline could be indicative of broader market trends or specific challenges faced by the company. Either way, it’s a topic that deserves a closer look. Understanding the factors behind this decline can provide valuable insights into the company’s operations and potential future performance.

Impact of the US Dollar and Consumer Weakness: A Double-Edged Sword

The US Dollar’s Recent Drop

The US Dollar’s recent drop is like a ripple in a pond, affecting everything from earnings to global trade. But is it a boon or a bane? On one hand, it might help corporate earnings, but on the other, it could mask underlying weaknesses. Let’s explore this complex relationship and what it means for investors. The fluctuation in currency can have both direct and indirect effects on companies, influencing everything from export competitiveness to the cost of raw materials.

Consumer Weakness and Inflation

Consumer weakness and inflation are intertwined in a delicate dance. When consumers pull back, it can lead to a drop in corporate revenues. Add inflation to the mix, and you have a recipe for uncertainty. How are companies navigating this landscape? What does it mean for future growth? These are questions worth pondering. Understanding consumer behavior and inflationary pressures can provide valuable insights into market dynamics and potential investment opportunities.

Earnings Reports Analysis: The Good, the Bad, and the Ugly

United Airlines: Flying High or Grounded?

United Airlines has been making headlines, but is it for the right reasons? From operating margins to passenger revenue, we’ll dissect the numbers. Are they soaring to new heights or stuck in a holding pattern? The answers might surprise you. Analyzing the performance of airlines can be complex, with factors such as fuel costs, passenger demand, and global events playing a significant role. Understanding these dynamics can provide a clearer picture of the industry’s health and future prospects.

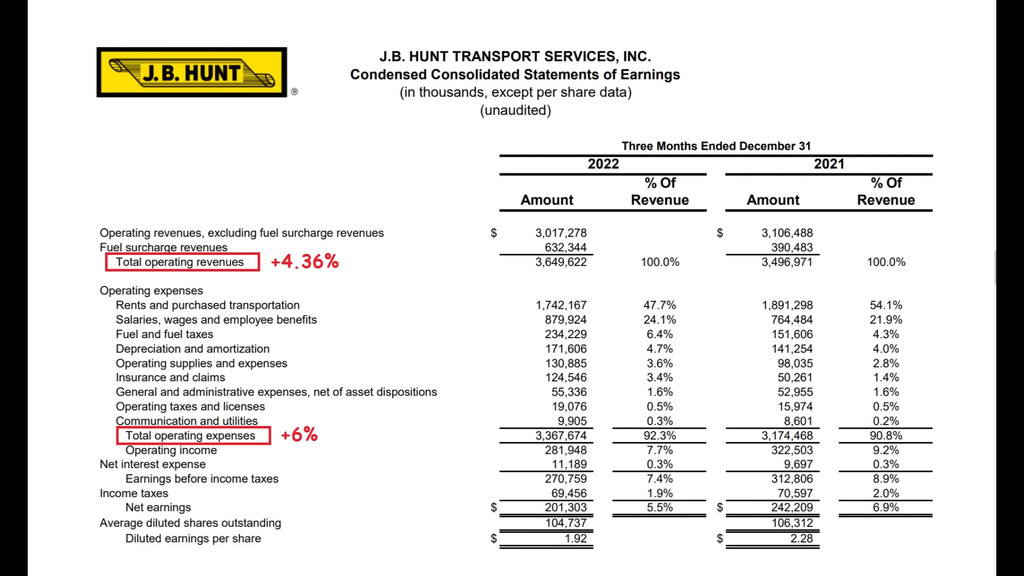

Revenue Growth vs. Expense Growth: JB Hunt’s Performance Indicators

JB Hunt’s year-on-year revenue growth was 4.36%, while the growth rate in expenses was 6%. This discrepancy, where expenses are growing faster than revenues, is seen as a bad leading indicator for the company. It raises concerns about the company’s ability to manage costs effectively and may signal potential challenges ahead.

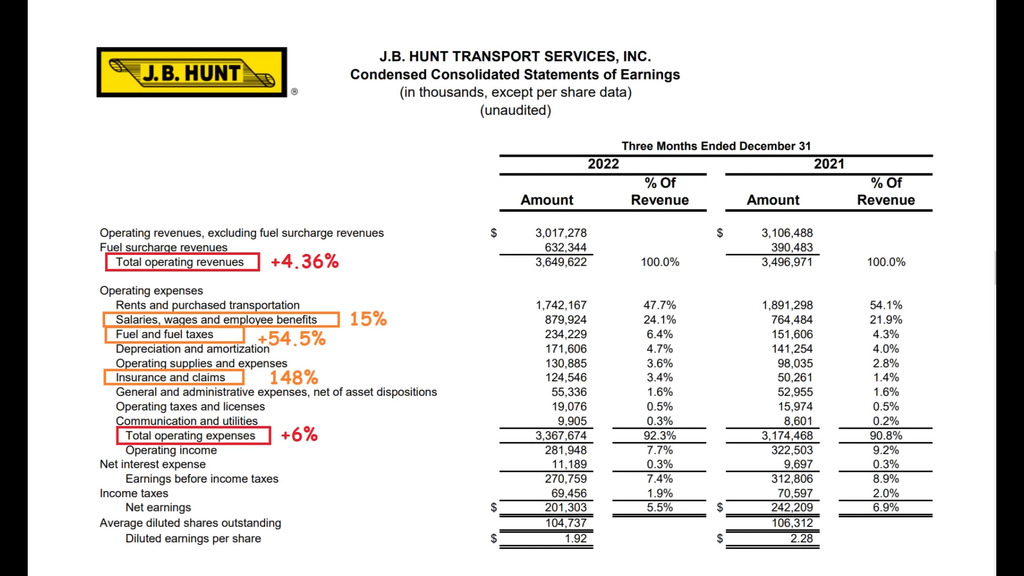

Breakdown of Expenses: A Closer Look at the Numbers

- Wages: Up 15% year-on-year. This increase may reflect higher labor costs or additional hiring.

- Fuel Expenses: Up 54.5% year-on-year. Rising fuel prices or increased consumption could be contributing factors.

- Insurance and Claims: Up 148% year-on-year. This dramatic rise may be indicative of broader industry trends or specific challenges within the company.

Net Earnings and Operating Margin: Assessing Profitability

Net earnings are down by 19% year-over-year, and the operating margin (the amount the company keeps from each dollar generated in revenue) is 7.72%. This is viewed as a poor performance and may raise questions about the company’s profitability and efficiency.

Technical Analysis: Understanding Market Trends

The company’s positive trend was broken, and it has entered a consolidation phase with resistance at 195.45. If it breaks above this number, it could rally to 209.41. However, the broken trend and consolidation phase may lead to failure, as seen in the past. This technical analysis provides insights into the market’s perception of JB Hunt and potential investment strategies.

Investment Banks and Other Corporations: A Closer Look

Goldman Sachs and Morgan Stanley: A Tale of Two Banks

Goldman Sachs and Morgan Stanley are like the titans of investment banking. But how are they faring in today’s market? We’ll compare trends, themes, and performances to give you an inside look at these financial giants. Investment banking is a complex and highly competitive field, with factors such as regulatory changes, economic conditions, and client demand shaping the landscape. Understanding these dynamics can provide valuable insights into the industry’s health and future prospects.

Schlumberger: Digging Deep

Schlumberger’s positive revenue growth and net income are more than just numbers; they tell a story of resilience and innovation. What’s driving these positive trends? How is Schlumberger positioning itself for the future? Let’s dig deep and uncover the answers. The energy sector is constantly evolving, with technological advancements, regulatory changes, and global events shaping the industry. Analyzing Schlumberger’s performance can provide a window into these dynamics and potential investment opportunities.

Trading Strategies and Options: Play Smart

- Positioning Ahead of Time

In trading, timing is everything. Positioning ahead of time, especially during earnings season, can make or break a trade. We’ll share insights, strategies, and tips to help you play smart and stay ahead of the game. Understanding market trends, analyzing historical data, and anticipating future movements can provide a competitive edge in trading. These insights can guide investment decisions, risk management, and overall trading strategies.

- Lessons from Trading Options

Trading options is like playing chess; it requires strategy, foresight, and sometimes, learning from mistakes. We’ll explore lessons learned, common pitfalls, and how to navigate the complex world of options trading. Options trading is a multifaceted and often misunderstood investment tool. Understanding the mechanics, risks, and rewards of options trading can provide additional opportunities for investors and traders alike.

Overall Market Trends and Indicators: What’s Next?

Identifying Trends and Leading Indicators

The market is like a living organism, constantly evolving and changing. Identifying trends and leading indicators is essential for staying ahead. What’s on the horizon? What should you watch for? We’ll explore these questions and more. Recognizing market trends and leading indicators can provide a competitive edge, guiding investment decisions, portfolio management, and overall market understanding.

Quarter-Over-Quarter Changes and Macroeconomic Data

Quarter-over-quarter changes offer a snapshot of a company’s health. Coupled with macroeconomic data, they provide insights into broader market trends. Why are these changes important? How can they guide investment decisions? Let’s find out. Analyzing quarter-over-quarter changes, along with macroeconomic data, can provide a holistic view of the market, uncovering trends, opportunities, and potential risks.

Specific Metrics and Details: The Devil’s in the Details

Operating Margins, Net Income, and Revenue Growth

The devil’s always in the details, and in finance, those details are often found in metrics like operating margins, net income, and revenue growth. We’ll explore these metrics, what they mean, and why they matter. Understanding these financial metrics can provide a deeper insight into a company’s performance, guiding investment decisions, risk assessment, and overall market understanding.

Average Revenue Per Membership and More

From average revenue per membership to sector-specific insights, we’ll cover a range of metrics that offer a deeper understanding of companies and industries. These details are more than just numbers; they’re insights that can guide investment strategies. Recognizing and analyzing these specific metrics can provide a competitive edge, uncovering opportunities, trends, and potential risks within various sectors and industries.

Conclusion: Wrapping It Up

So, there you have it, a comprehensive analysis that’s as human as it gets. From earnings reports to investment strategies, we’ve covered it all. Feeling more informed? We hope so! The world of finance is a complex and fascinating place, filled with opportunities, challenges, and endless learning curves. Whether you’re an investor, trader, or financial analyst, understanding these insights can make all the difference.

Remember, the world of finance is ever-changing, and staying informed is key. Knowledge is power, and in the financial world, it’s the currency that can lead to success. Keep exploring, keep learning, and never stop growing in your financial journey. Happy investing, and see you in the market!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)