The financial market is a complex ecosystem, constantly evolving and adapting to various factors. Recently, it has been dominated by a phenomenon known as rebalancing, particularly with the NASDAQ and the so-called “Magnificent Seven” stocks. This article aims to dissect this trend, its implications, and the potential landmines that could trigger a mass exodus from these big seven names.

The Rebalancing Phenomenon

Rebalancing is a strategy employed by investors to realign the weightings of their portfolio. It involves periodically buying or selling assets to maintain an original or desired level of asset allocation or risk. Recently, this strategy has been employed on a grand scale with the NASDAQ and the “Magnificent Seven” stocks, which include some of the biggest names in the tech industry.

These stocks have become so large that they are now considered “too big to fail.” The collapse of any of these stocks could potentially bring down the entire market, causing a ripple effect that could be felt across the global economy. To mitigate this risk, investors are rebalancing their portfolios, reducing the size of these massive names in the index.

The Potential Landmines

While rebalancing is a prudent strategy, it does not eliminate all risks. There are potential landmines that could still trigger a mass exodus from these big seven names. These include concerns about China’s economy, earnings, and the Federal Reserve’s (FED) policies.

China’s economy, for instance, is facing stagnation, which could have far-reaching implications for the global market. Similarly, earnings reports could reveal weaknesses in these companies that could lead to a sell-off. Lastly, the FED’s handling of inflation and interest rates could also influence investor sentiment and market dynamics.

The Role of the Federal Reserve

The Federal Reserve, often referred to as the Fed, plays a pivotal role in the U.S. economy and, by extension, the global financial landscape. As the central bank of the United States, it’s tasked with promoting economic stability through the management of monetary policy. This includes controlling inflation, regulating financial institutions, maintaining the stability of the financial system, and providing financial services to depository institutions.

In recent times, the Fed has been under intense scrutiny for its handling of inflation and interest rates. Critics argue that the Fed needs to adopt a more aggressive approach to curb inflation, which has been rising at an alarming rate. The Fed’s traditional tool for managing inflation is adjusting the federal funds rate, the interest rate at which banks lend to each other overnight. By raising this rate, the Fed can slow economic activity and, in turn, reduce inflation.

However, this is a delicate balancing act. Raising interest rates too quickly can stifle economic growth and lead to a recession. On the other hand, if the Fed is too slow to act, it could allow inflation to spiral out of control, eroding purchasing power and potentially leading to an economic crisis.

The Fed’s actions have far-reaching implications. They can influence investor sentiment, market dynamics, and the broader economy. Therefore, the Fed’s role and its decisions are closely watched by investors, financial institutions, and governments worldwide. As we navigate the current financial landscape, the Fed’s role and its handling of inflation and interest rates will continue to be a focal point of discussion and analysis.

The Impact on Bank Earnings

Bank earnings are a crucial barometer of the health of the financial sector and the broader economy. They reflect the profitability of banks and are influenced by a variety of factors, including interest rates, loan demand, default rates, and regulatory environment.

In the current financial landscape, bank earnings are under significant pressure. The Federal Reserve’s handling of interest rates is a key concern. When the Fed raises interest rates, it can increase the cost of borrowing, which can reduce loan demand and squeeze banks’ net interest margins – the difference between the interest income generated by banks and the amount of interest paid out to their lenders.

Moreover, tightening financial conditions can lead to an increase in default rates. As borrowing becomes more expensive, businesses and individuals may struggle to repay their loans, leading to higher default rates. This can result in significant loan losses for banks, further impacting their earnings.

Another factor impacting bank earnings is the regulatory environment. Stricter regulations can increase compliance costs and limit banks’ ability to engage in certain profitable activities. For instance, new rules for large lenders being put in place by the Federal Reserve could potentially impact their profitability.

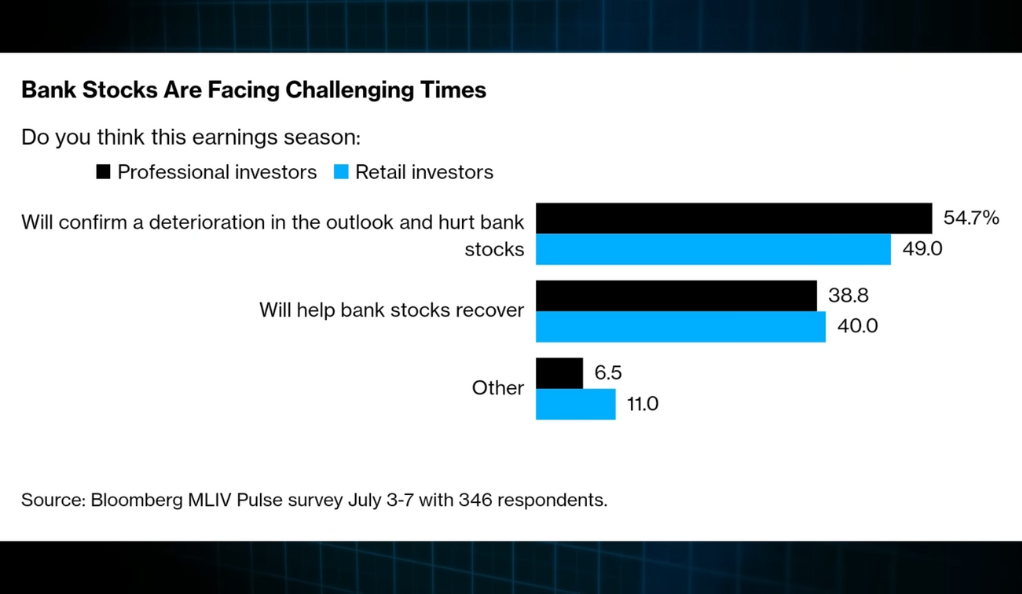

In the upcoming earnings season, these factors will be closely watched. Any signs of deterioration in bank earnings could have significant implications for the financial sector and could potentially trigger broader market volatility.

The Rivalry Between Musk and Zuckerberg

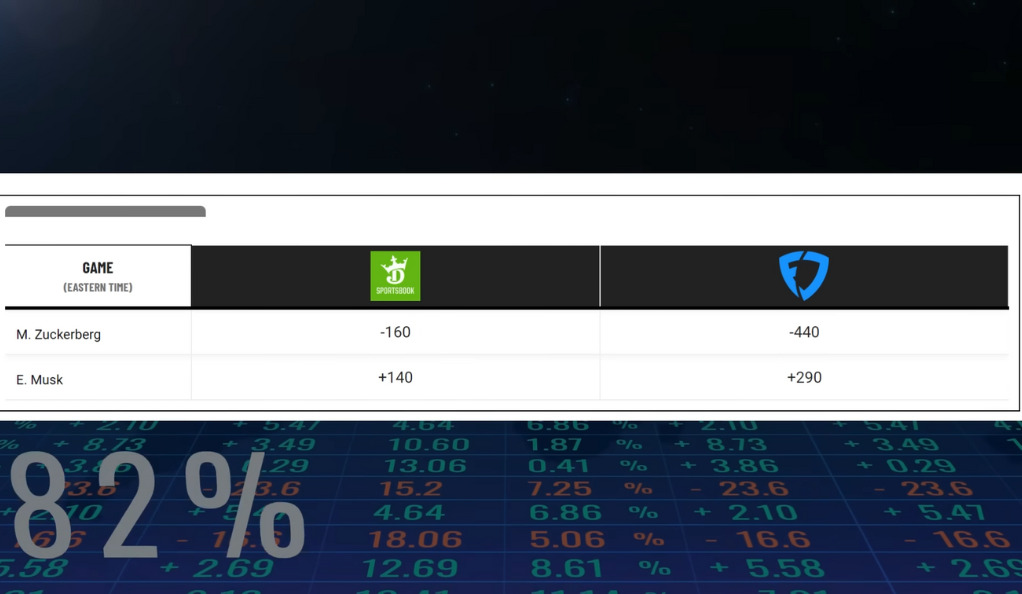

The rivalry between Elon Musk, the CEO of Tesla and SpaceX, and Mark Zuckerberg, the CEO of Meta Platforms, has become a fascinating subplot in the tech world. Both are visionary leaders who have built transformative companies, but their contrasting views on various issues have led to a public feud that has captured the attention of the tech industry and beyond.

The rivalry intensified when Musk purchased Twitter, promising to bring free speech to the platform. This move was seen as a direct challenge to Zuckerberg’s Meta Platforms, which has been criticized for its handling of free speech and misinformation on its platforms, including Facebook and Instagram.

In response, Zuckerberg launched a new platform called Threads, which quickly amassed over a hundred million users. This rapid growth is seen as a significant threat to Twitter’s user base and could potentially impact its profitability.

The rivalry between Musk and Zuckerberg is not just about their respective companies. It’s also a clash of ideologies and visions for the future of the internet and social media. As both leaders continue to innovate and push boundaries, the tech world will be watching closely to see how this rivalry unfolds and what it means for the future of their respective companies and the tech industry as a whole.

The Metaverse Project and Meta’s Financial Health

Meta Platforms, formerly known as Facebook, has been making significant investments in its ambitious metaverse project. The metaverse, a virtual reality space where users can interact with a computer-generated environment and other users, is seen as the next frontier in social media and online interaction. Mark Zuckerberg, Meta’s CEO, has described it as the “next chapter” for the internet.

However, this ambitious project has had significant financial implications for Meta. The company has been spending heavily on the development of the metaverse, leading to a decrease in its profit margins. In fact, Meta’s expenses have surged significantly since 2016, while its operating profits have been dropping.

This heavy spending, coupled with a decrease in net income, has raised concerns about Meta’s financial health. Despite a recent rebound in its stock price, the company’s financials show a company under pressure. Its revenues have increased by only 3% while expenses have risen by 10%, leading to a 24% drop in net income.

As Meta continues to invest in its metaverse project, it will be crucial to see how it manages these financial challenges and whether the metaverse can deliver the revenue growth and profitability that the company and its investors are hoping for.

The Current State of the Market

The current state of the market is characterized by a mix of optimism and caution. On one hand, investors are chasing stocks and driving up prices, leading to a bubble in the market, particularly in the largest companies. This is fueled by a belief in the continued resilience of the economy and the potential for further growth.

However, this optimism is tempered by concerns about various factors. The Federal Reserve’s handling of inflation and interest rates is a key concern. The Fed’s decisions can significantly impact the market, influencing investor sentiment and market dynamics. There are fears that if the Fed raises interest rates too quickly or too high, it could trigger a recession and a potential market crash.

Another concern is the potential impact of macro events, particularly those involving China and the United States. The strained relationship between these two economic powerhouses and the potential for economic stagnation in China could have significant implications for the global economy and, by extension, the market.

Furthermore, there are concerns about the upcoming earnings season, particularly for banks. Any signs of deterioration in bank earnings could trigger broader market volatility. As such, investors are closely watching these developments and adjusting their strategies accordingly.

Conclusion

The current financial landscape is a complex web of factors, from rebalancing strategies and potential landmines to the actions of the Federal Reserve and the earnings of banks. Amidst all this, the rivalry between two tech giants adds another layer of intrigue. As investors, it’s crucial to stay informed and make decisions based on a comprehensive understanding of these dynamics. After all, in the world of finance, knowledge is power.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)